The back office has often been seen as the tired, plodding workhorse of the asset management industry: an anachronistic mishmash of legacy systems that is better suited to being put out to pasture than to running in the Grand National. However, after decades of underinvestment by investment managers and limited technological innovation, it is now a top strategic priority.

Why now? Market evolution and growing cost pressures

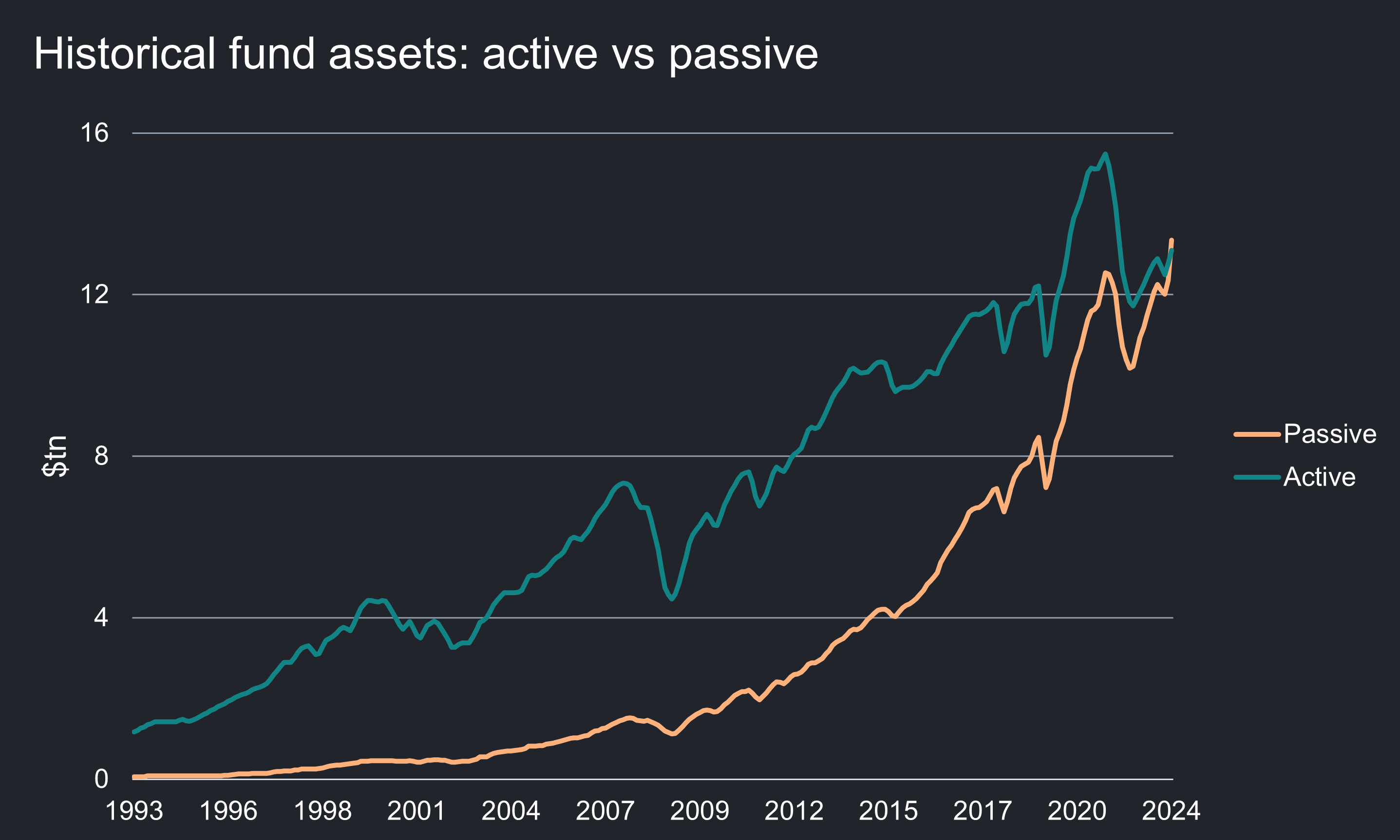

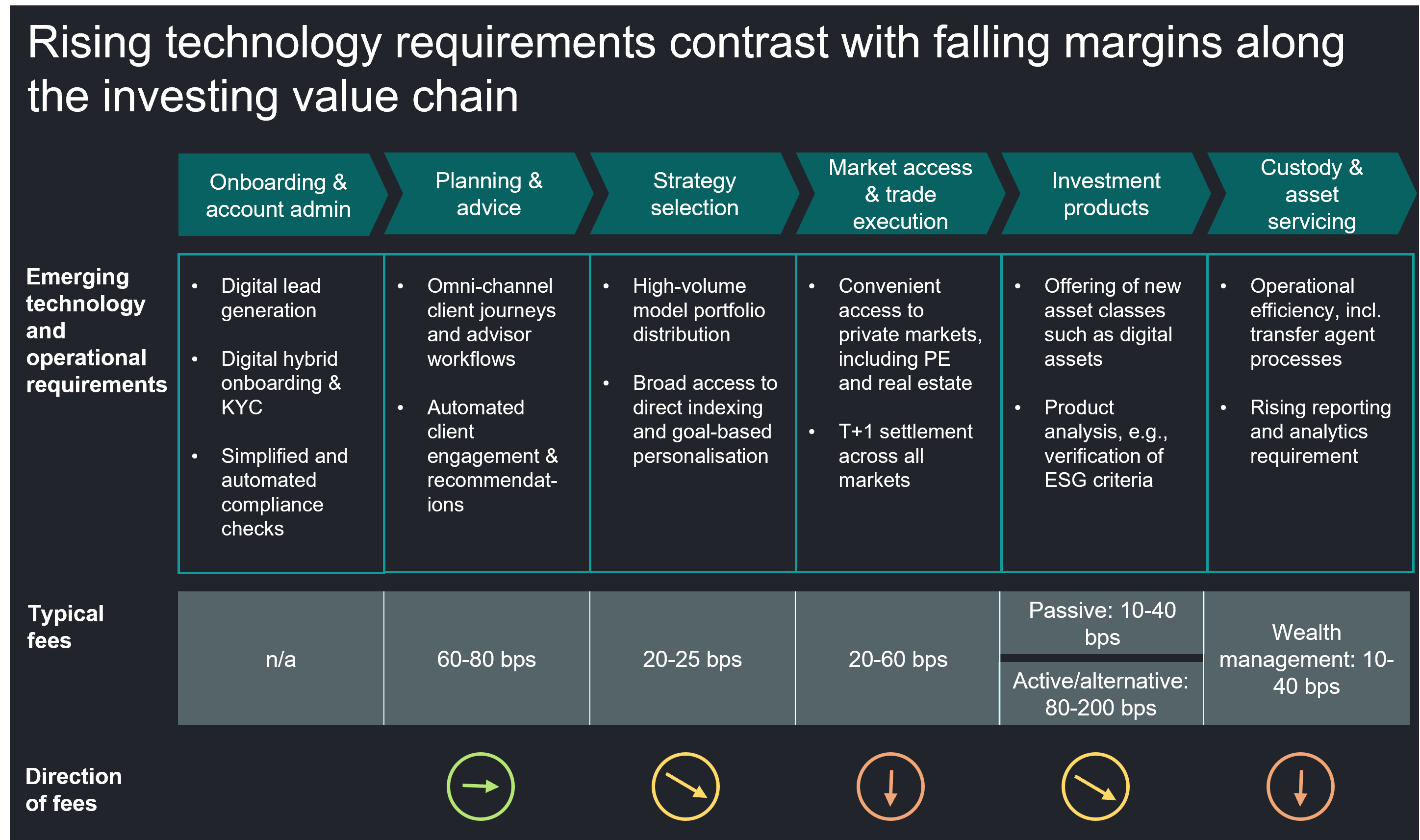

Over the past two decades, the investment landscape has undergone a dramatic transformation. Once dominated by mutual funds, the industry has seen substantial growth in passive investment strategies and a marked decline in actively managed products.

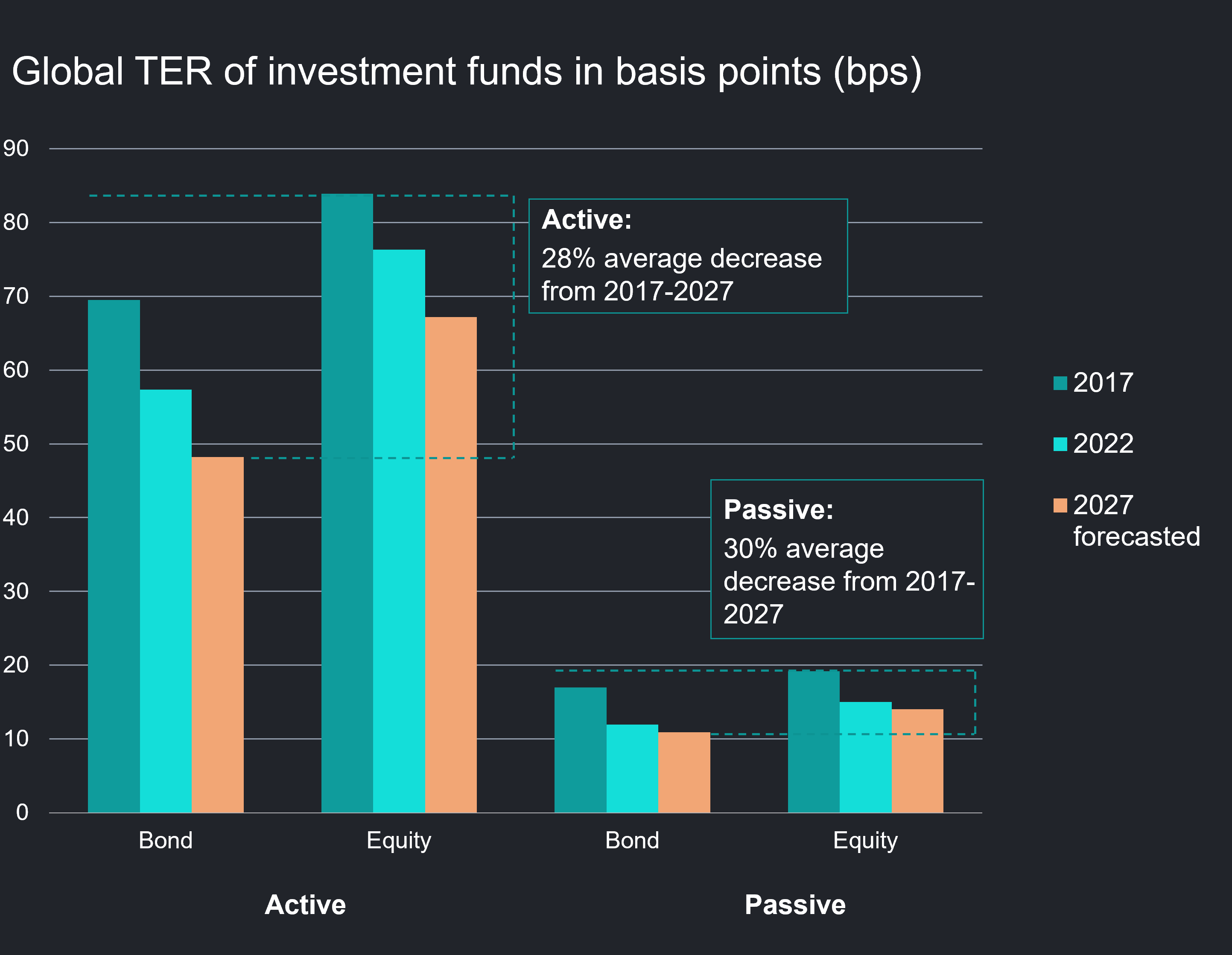

Unlike mutual funds managed by star stock-pickers, passive index trackers are fundamentally a commodity product differentiated only in brand name or pricing. Therefore, it is little surprise that they have seen intense price competition and consequent margin compression.

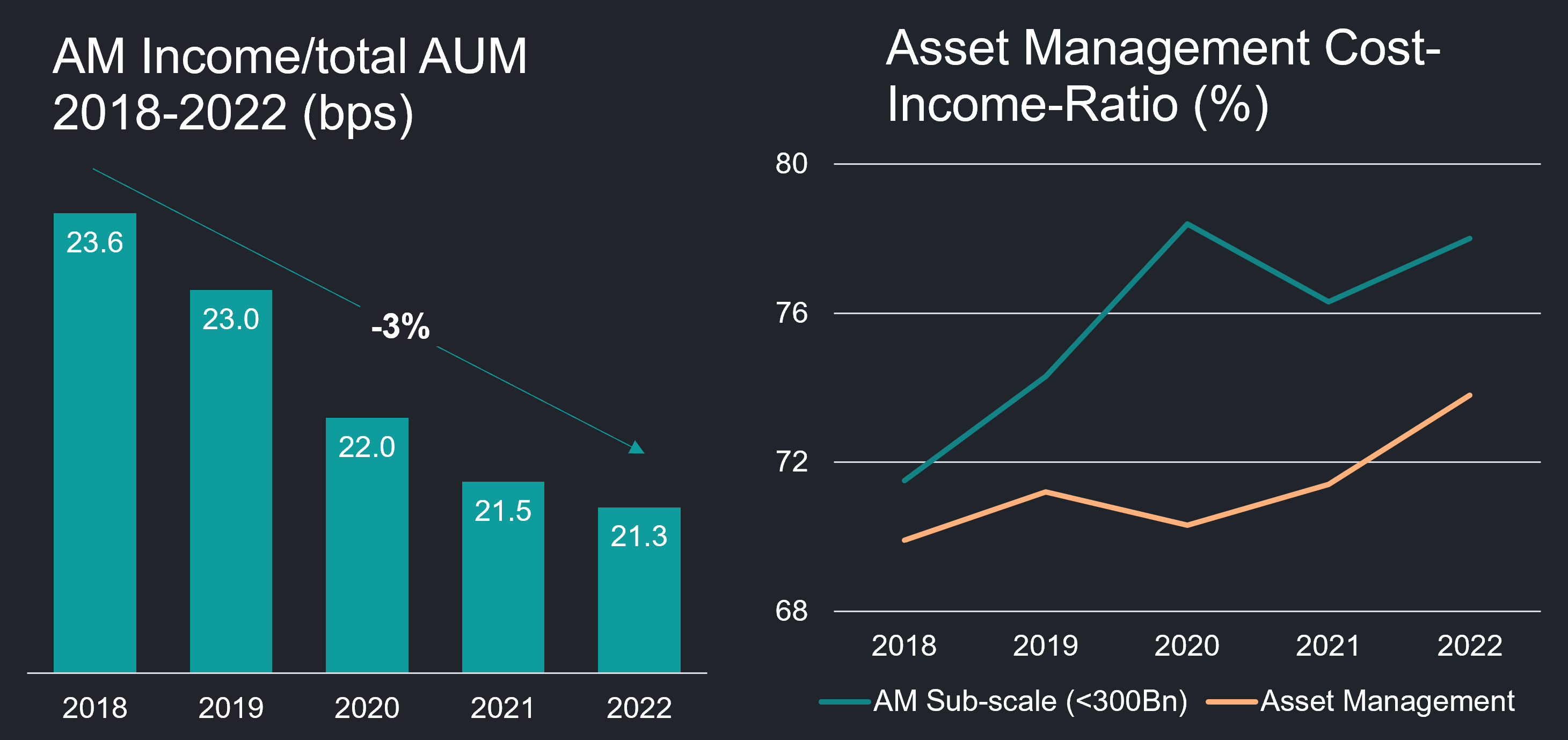

This shift from higher-fee actively managed products to lower-fee passive products has significantly contributed to the decreasing margins of the asset management business.

At the same time, regulatory frameworks have become more complex and often disparate, leading to considerable overheads as firms have scrambled to hire compliance staff to placate zealous regulators, fend off large fines and mitigate against reputational damage. Growing consumer demands for greater transparency and reporting around ESG factors are also compounding the pressure.

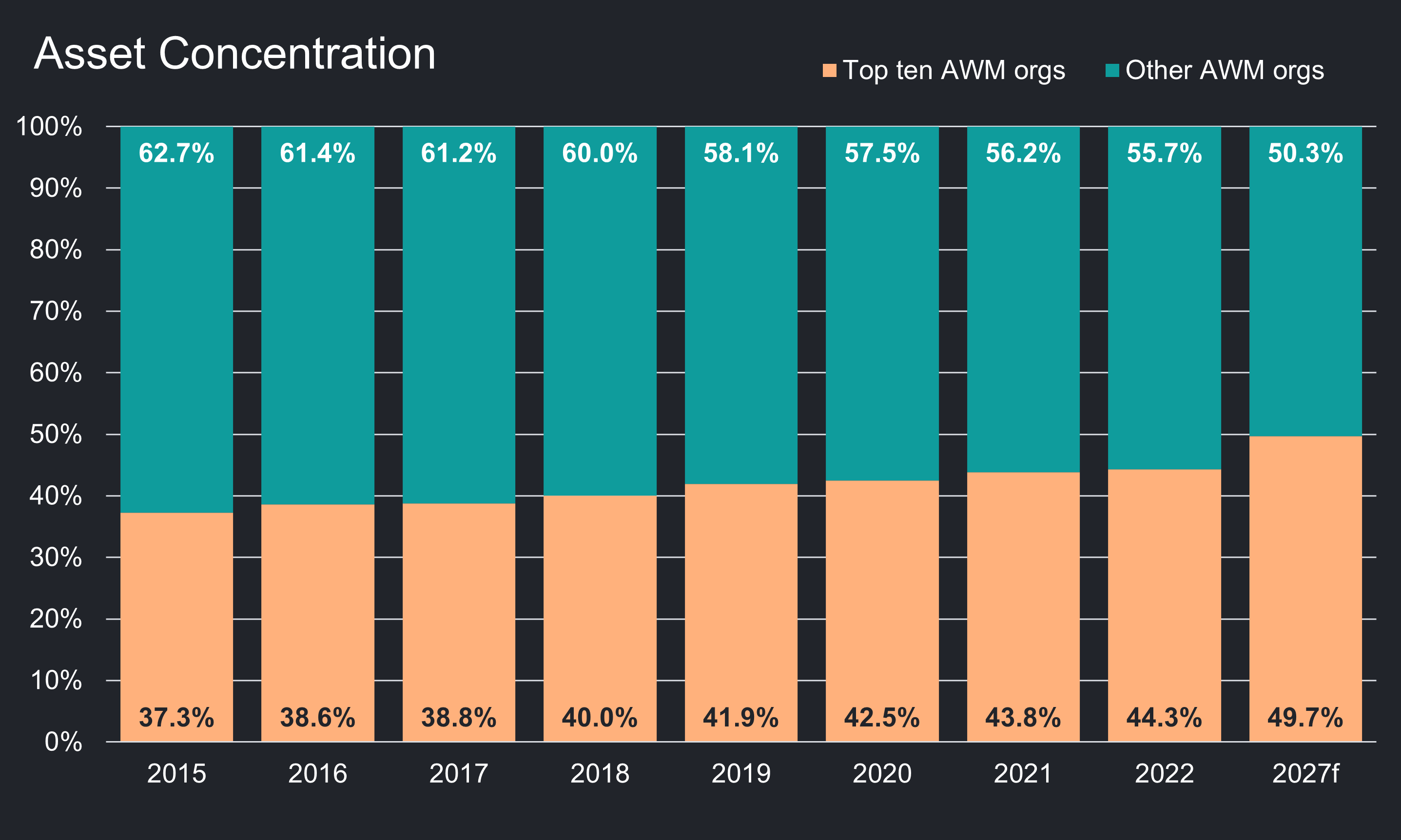

In response to these challenges, the asset management industry has responded with vertical and horizontal integration, scaling both across existing business lines and vertically into new potential sources of higher margin business, such as private assets. This is happening both organically, with managers raising larger and larger funds, and inorganically, with mergers such as Franklin Templeton’s $4.5bn acquisition of Legg Mason, Jupiter’s acquisition of Merian, and the £11bn merger of Aberdeen and Standard Life back in 2017.

The industry is therefore transitioning from one with greater fragmentation and extremely high margins to an increasingly consolidated market structure with lower margins, where only the largest and most adaptable managers can persist.

Legacy technology is a barrier to cost reduction and product innovation

Despite the dramatic market structure evolution over recent decades, back-office operations have lagged, failing to adapt to the demands of the new landscape.

Back-office functions were established in a simpler market environment with a smaller number of generic products. Over the decades since the launch of the first modern mutual fund in 1924, the back-office infrastructure supporting the industry has grown organically, responding to changes iteratively rather than through cohesive, central design.

Back office infrastructure today is not fit for purpose. A recent State Street survey demonstrated this, showing that the average institution needs to upgrade >50% of its existing technology to meet its data goals.

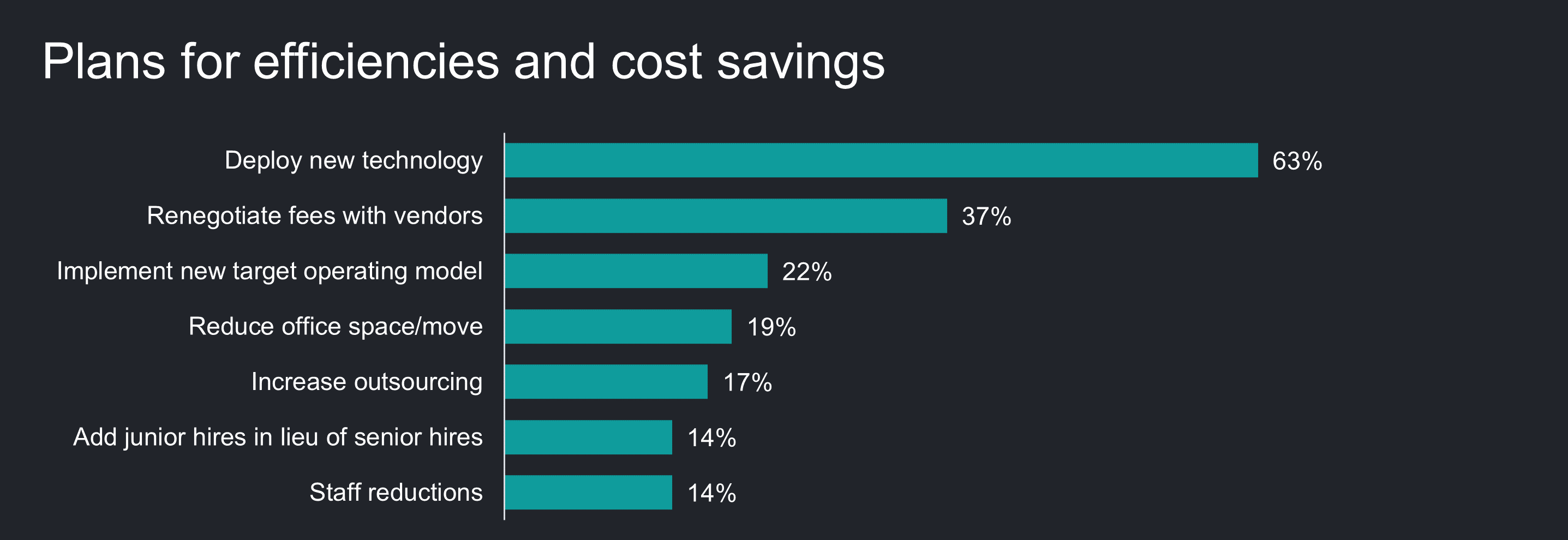

One proposed solution has been to outsource certain back office functions to 3rd party asset servicers (a recent BNY study indicated that 46% of managers were looking to increase their back office outsourcing). However, while outsourced providers admittedly enjoy some economies of scale, in many cases the same manual processes operated by an asset manager have simply been moved from one office to another without being automated or streamlined. Until the nature of the work itself is changed, investment managers still pay one way or another. Fundamentally, the back office challenge must be solved with new technological infrastructure and superior processes (either in-house by the asset manager or externally by the asset servicer).

Caught between the hammer of downward fee pressure and the anvil of growing operational overheads, financial institutions are compelled to seek innovative solutions to boost profitability and efficiency.

Embracing Digital Transformation in the Back Office

The back office is stepping into the future, driven by significant scrutiny of costs at every level of the investment stack and a need for technology that can support new (and higher fee) investment products.

Investment managers have come round to the fact that they need to deploy new technologies across the back office to capitalise on their greater scale, manifest cost savings, and ultimately drive greater profitability.

Process digitisation and STP: many back office processes, such as fund accounting and performance measurement and attribute, frequently require manual processes and reconciliations, as workflows are managed across a series of different ageing point solutions. These processes are being digitised either through RPA-style solutions or by using modern software to govern the entire workflow.

Architectural rationalisation and improved data management: asset managers' architectures have evolved over many years and are now a tangled web of integrations across a multiplicity of internal and 3rd party systems with extremely poor data quality and provenance. Innovative managers are transitioning towards data-centric architectures with a single version of truth for investment data. (supported by modern data management systems such as Finbourne’s LUSID platform, a FISV portfolio company).

Migrating to the cloud: many asset managers still run in house and 3rd party software on-premise and have for many years been in the process of migrating more and more of their estate into the cloud. A transition from legacy applications to SaaS constitutes part of this and is supported by efforts towards greater architectural rationalisation and data management.

The promise of blockchain: tokenisation of funds has long been hailed as a potential step change in back office operations. While few funds are using the technology at scale, there are some green shoots with projects such as Hamilton Lane’s partnership with Securitize for fund tokenisation and Fidelity International’s tokenisation of a money market fund on JP Morgan’s onyx platform. Platforms such as FundsDLT (acquired by Deutsche Borse) and Fund Admin Chain (acquired by Apex) in particular offer back-office benefits for the launching, distribution, trading, and settlement of funds but have yet to enter the mainstream.

As financial services institutions embrace this digital transformation, they are not merely updating their back office systems; they are redefining their capabilities to meet the needs of a more complex and demanding market. This shift ensures that they can offer tailored solutions to a diverse and expanding investor base while managing the growing volumes of data with greater efficiency.

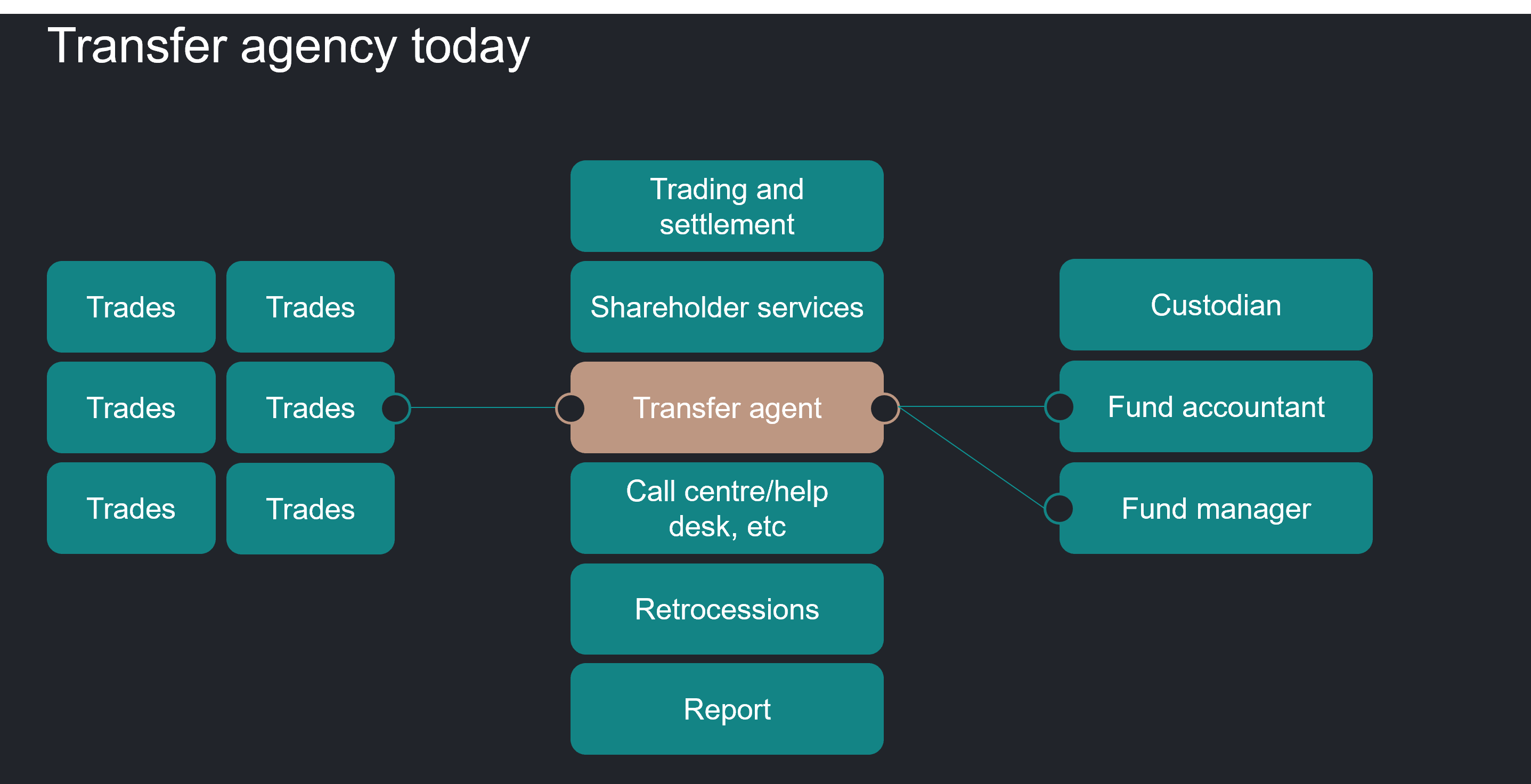

Case Study: Transfer Agents of Change

One area seeing dramatic innovation is the once sleepy domain of transfer agency. In the funds industry, transfer agents (TAs) manage and update the register of who owns what in a given investment fund, such as a mutual fund or ETF. One can think of a TA as managing the ‘cap table’ for a fund and the associated activities that sit adjacent to this: anti-money laundering checks, regulatory reporting, document collation and dissemination, error reconciliation and corporate action processing.

Today, TA services tend to fall into one of three categories: performed in-house by asset managers (such as L&G and Fidelity International); outsourced to large asset servicers (including large custodial banks such as State Street, BNY Mellon, JP Morgan and Citi); or managed by non-custodial asset servicers (such as SS&C).

Despite their large scale, incumbent providers are often running on legacy systems that were developed many decades ago. The worst offenders were developed in the late 1980s and 1990s and don’t have a graphical user interface, instead providing only green text on a black screen.

This technological stagnation has resulted in a multitude of operational headaches and piecemeal solutions as TAs scramble to meet customer demands. The result is a landscape rife with inefficiencies and makeshift fixes, including region-specific TA platforms (instead of a unified global solution), subpar user experiences, and incredibly long integration and migration timelines. These issues culminate in process flows heavily reliant on manual processes, making the addition of new funds or asset classes (such as modern alternative products) both costly and challenging.

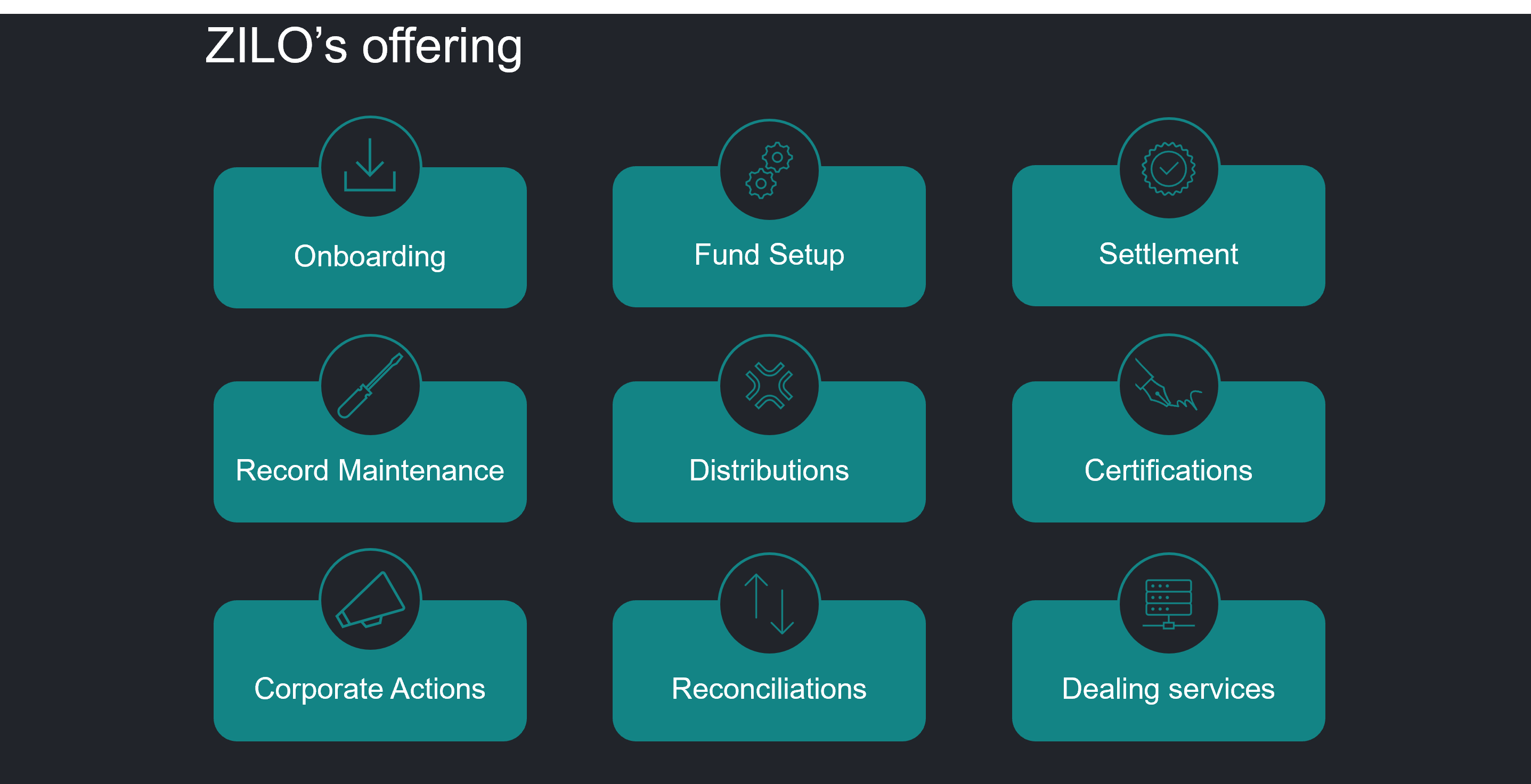

Enter ZILO. ZILO is a next-generation transfer agency software platform, founded by Phil Goffin (co-founder of Calastone and former CTO of FNZ). FISV co-led the company’s Series A round alongside Portage at the beginning of 2024. As a global cloud-based TA software solution, ZILO aims to reimagine every aspect of TA software to create a platform that is adaptable and able to scale with modernising services. The platform manages all aspects of TA, including client and agency services, investment services, and fund services and reconciliation.

Rather than a monolithic stack, the platform uses a modern microservices architecture where the integration of standalone modules is extremely simple. The team has also built an AI engine for managing migrations onto their platform that is yielding astonishing results and could even lead to an end to the current year-long process that migrating books of business involves.

3.png)

The platform has been built with the future in mind. If there is client demand over the medium-long term for managers to tokenise their funds and use DLT as a system of record, ZILO already has the technology in place to support this.

Transfer agency is an archetypal example of how a clunky and expensive area of the back office can be dramatically simplified and automated with modern software and the benefit will be deeply felt by asset managers, whether directly or through a better and cheaper service provider by their asset servicers.

Conclusion

As the back office is dragged into the future, we will see more players like ZILO come to the fore and increasing displacement of legacy vendors that have failed to innovate. Whether or not outsourcing becomes the dominant model for investment operations - there is a deep need to change the very nature of work in the back office to tackle crippling overheads.

If you’re a founder building in the space, we would love to hear from you. Please reach out on LinkedIn.

Hero image generated via Chat GPT.