The UK's Fintech Edge: How to Keep the Crown

It’s not your average Wednesday that kicks off with coffee in Downing Street, but that’s where I found myself last Wednesday as Chancellor Rachel Reeves brought together a group of fintech investors to discuss a key question: How do we retain and grow the UK as a fintech hub?

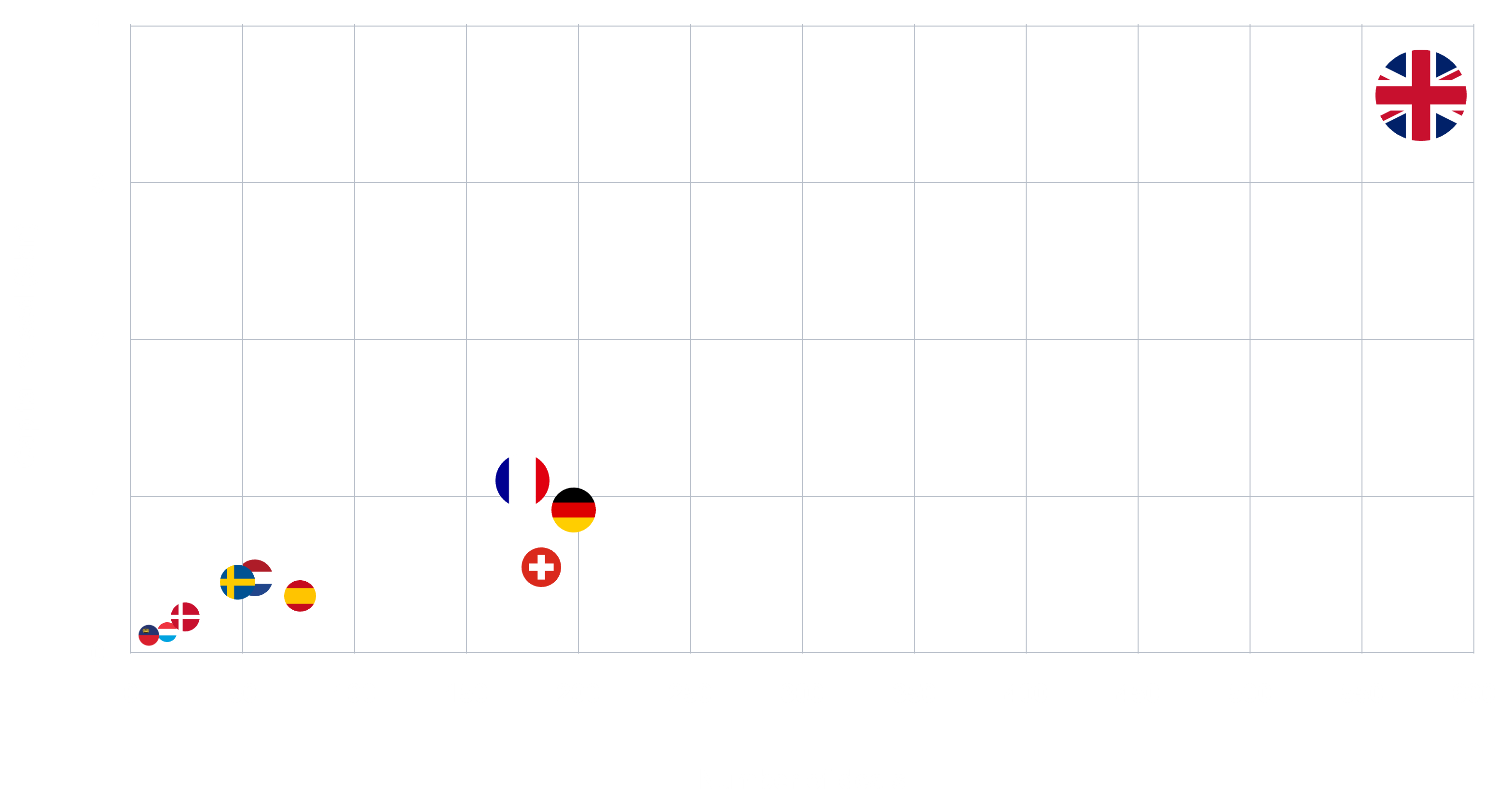

Undoubtedly, UK fintech still punches above its weight. In 2024, it attracted $3.6 billion across 576 deals, capturing half of all fintech funding in Europe and ranking second only to the US. The UK is also home to 52 of Europe’s 121 fintech unicorns – no small feat.There’s long been something quietly gritty and ambitious about the UK fintech scene.

But beyond the stats and soundbites, there was a shared sense that something’s shifting. The foundations that made the UK a fintech powerhouse over the last decade are starting to show signs of strain. Countries like India and Singapore are moving fast, bolstered by strong ecosystems and bold policy. The UK still has an edge, but one that is increasingly fine.

So, what needs to change? I don’t pretend to have all the answers, and our discussion covered far more than I can attempt to squeeze into one article. But in the room, and beyond, five big themes keep surfacing which I believe are critical if we want the next wave of global fintech leaders to build, scale and stay here.

1. Bridging the growth-stage gap

The UK has built a strong foundation for early-stage fintechs. We benefit from a vibrant network of incubators, angel investors and VCs with deep roots and knowledge in the sector.

However, as companies reach the growth stage requiring deeper pockets of capital, the funding landscape starts to thin.

Many promising fintechs find themselves undercapitalised at the exact moment they need to scale. The problem isn’t a lack of ambition or potential. It is a structural shortage of domestic capital willing to take later-stage risks. According to the British Business Bank, late-stage US companies receive around 1.4 times more funding than their UK peers. In a large part, that’s because institutional investors in the UK have been hesitant to deploy capital into high-growth, unlisted companies. A steep contrast with countries like the US, Canada and parts of Europe, where pension funds play an active role in backing innovation.

Without the benefit of the same large-scale funding on their doorstep, UK startups often look abroad for growth capital or opt for an early exit. A missed opportunity not just for the companies but for the economy as a whole.

Will government policy move the dial? The original Mansion House Compact laid the foundations, with several major pension funds pledging to allocate at least 5% of their assets to unlisted UK equities by 2030. But more ambitious steps may be on the way. The so-called, Mansion House Compact II, expected to be unveiled in May, is rumoured to double that target to 10%, a move that could boost the pool of capital available for high-growth UK companies.

This new ambition isn’t without its challenges. Pension executives have raised valid concerns around risk, governance, and fiduciary duty. The government, meanwhile, has yet to clarify whether these targets will remain voluntary or edge toward being mandated. Striking the right balance between backing innovation while offering pension scheme members the best possible outcomes will be key.

The BVCA has also put forward a series of sensible proposals, including a UK version of France’s Tibi scheme, a central directory of approved private capital managers, and a new fund-of-funds model to help channel investment into emerging managers.

These initiatives could make a real difference, but they will only succeed with strong policy support and close coordination across the market.

If we want our most promising fintechs to scale and succeed here, we need to give them every reason to stay.

2. Rethinking the path to going public

There was a time when going public was the natural next step for high-growth firms. An IPO brought credibility, long-term capital, and a broader investor base.

Today, it feels less like a milestone and more like a major question mark, with many fintechs choosing to stay private for longer. Their reasons are understandable. Regulatory complexity and a spate of disappointing listings have dulled enthusiasm. Last year, fewer than 20 companies listed in London, the lowest number since 2009.

This shift is not without consequences. If companies stay private, exit opportunities dry up for earlier-stage investors, liquidity suffers, and capital gets locked up. Equally (and bringing us back to point one), delayed listings mean a concentration of wealth in private hands and the average UK saver missing out.

The Chancellor’s Financial Services Growth Strategy and the FCA’s five-year plan both recognise these risks. Efforts like reforms to the UK’s Listing Rules and the creation of the Private Investment Securities and Capital Exchange System (PISCES) are in motion, but momentum needs to build.

At the same time, if public markets remain unattractive, we need to build better ways for the public to invest in private winners, whether through pensions, ISAs, or diversified funds such as LTAFs.

3. Regulation as a friend, not a foe

Much of the UK’s fintech success can be traced back to thoughtful, forward-leaning regulation. The FCA’s regulatory sandbox remains a model for other jurisdictions, and Open Banking remains among the most advanced frameworks in the world.

This legacy of smart regulation helped position the UK as a magnet for fintech. But solid foundations don’t make a fortress. Other markets are catching up and, in some cases, pulling ahead.

Take crypto. The UK has long spoken about becoming a global hub for crypto and decentralised finance, but until recently, action lagged behind rhetoric. Meanwhile, the EU rolled out MiCA, and the US took clearer steps around stablecoins and exchange oversight.

That changed last week. In a timely move, the Chancellor unveiled a new set of crypto rules, bringing the UK more in line with the US model and confirming that crypto exchanges will fall under broader financial services regulation. It’s a welcome step, offering clarity and providing a firmer foundation for innovation in digital assets.

But this can’t be a one-off. Whether it’s crypto, open finance, or AI, the UK needs to stay ahead of the curve, not just keep up. That means regulators and government working hand in hand with industry, setting clear roadmaps, and moving at speed.

We’re seeing promising signals. The government’s upcoming Financial Services Growth Competitiveness Strategy places fintech at the heart of its economic ambitions, while the FCA’s new five-year plan also puts global competitiveness at the core of its mission, committing to streamline rules and develop open finance. The appointment of Colin Payne as Head of Innovation is another encouraging sign, bringing a fresh and balanced perspective shaped by both regulatory insight and commercial experience across major institutions like PwC, Lloyds Banking Group, HSBC, Barclays, and Wells Fargo.

The intent is here, but the proof of the pudding will be in the delivery. As Janine Hirt, CEO of Innovate Finance, aptly put it, “We don’t just need a joined-up approach between government, industry, and regulators; we need a shared level of urgency, with clear leadership and accountability.”

4. Betting big on AI

There’s no doubt about it: AI is transforming financial services — from personalised savings nudges to onboarding, KYC, and fraud prevention. (We unpacked the why behind this in our Q1 newsletter if you fancy a deeper dive.) The next wave of fintech won’t be defined by slicker apps; it’ll be defined by what’s under the hood, and increasingly, that’s AI.

The UK has a real edge here. Our universities are producing world-class research, and home-grown champions like DeepMind, Synthesia, and Faculty are driving much-needed cross-pollination between fintech and deeptech. But if we want to stay ahead, we need to double down and think bigger.

The government’s £1bn AI investment and the launch of the AI Opportunities Action Plan are strong moves. But in a global race where both governments and private industry are moving fast, some are questioning whether these steps are bold enough.

A case in point: the plan to build one of the UK’s largest AI data centres. As the Fintech Times pointed out, the proposed 100 MW capacity is a solid start but still lags the likes of the 150 MW already secured by Elon Musk’s xAI supercomputer.

If we are serious about staying a global fintech leader, we must also be serious about becoming an AI powerhouse.

Getting there will mean:

Clear regulation that enables responsible innovation

Ensuring we are delivering an AI talent pipeline, either home-grown or via immigration optionality

More R&D grants and dedicated AI skills programmes

Stronger collaboration between AI specialists and financial services

5. Capital beyond the capital

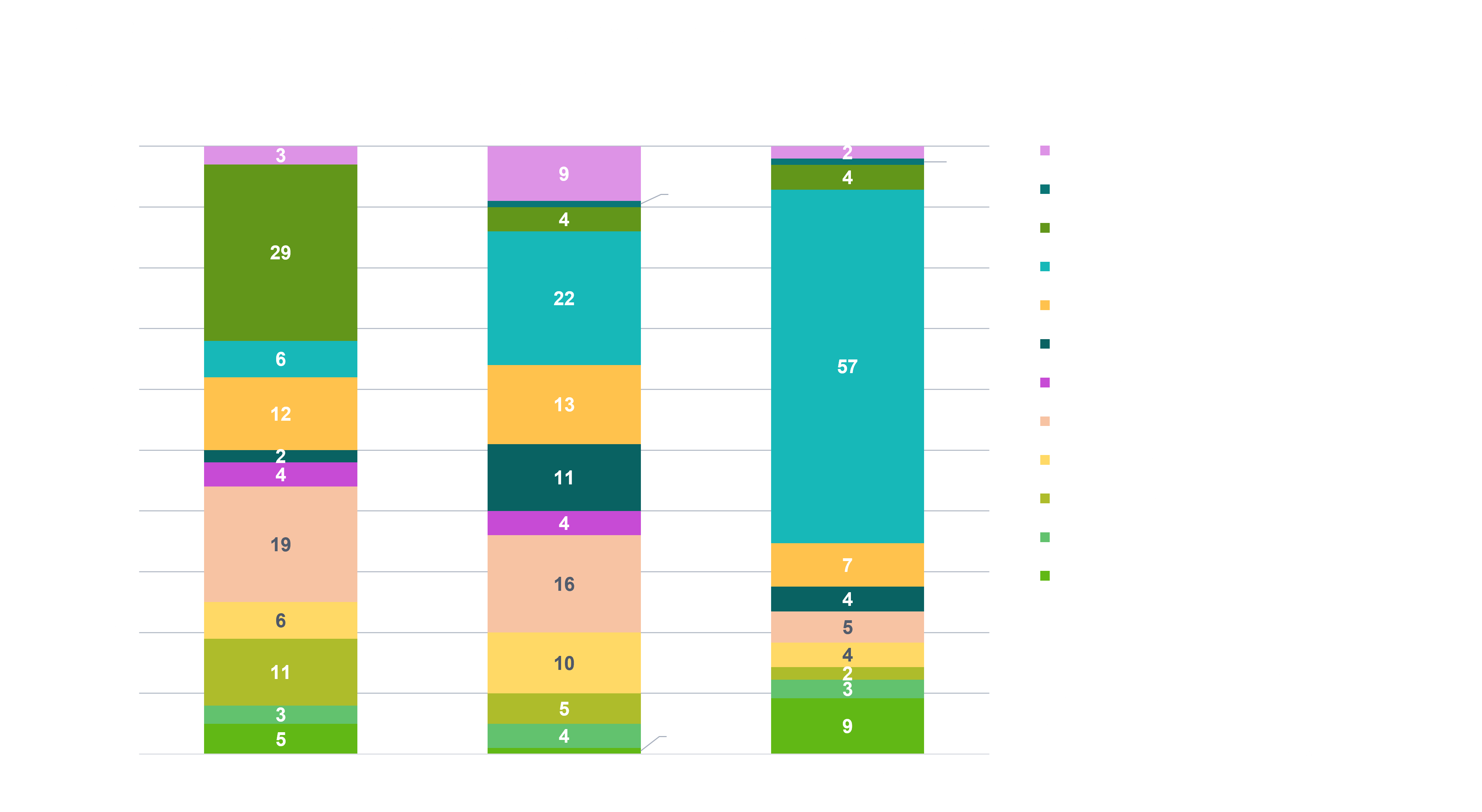

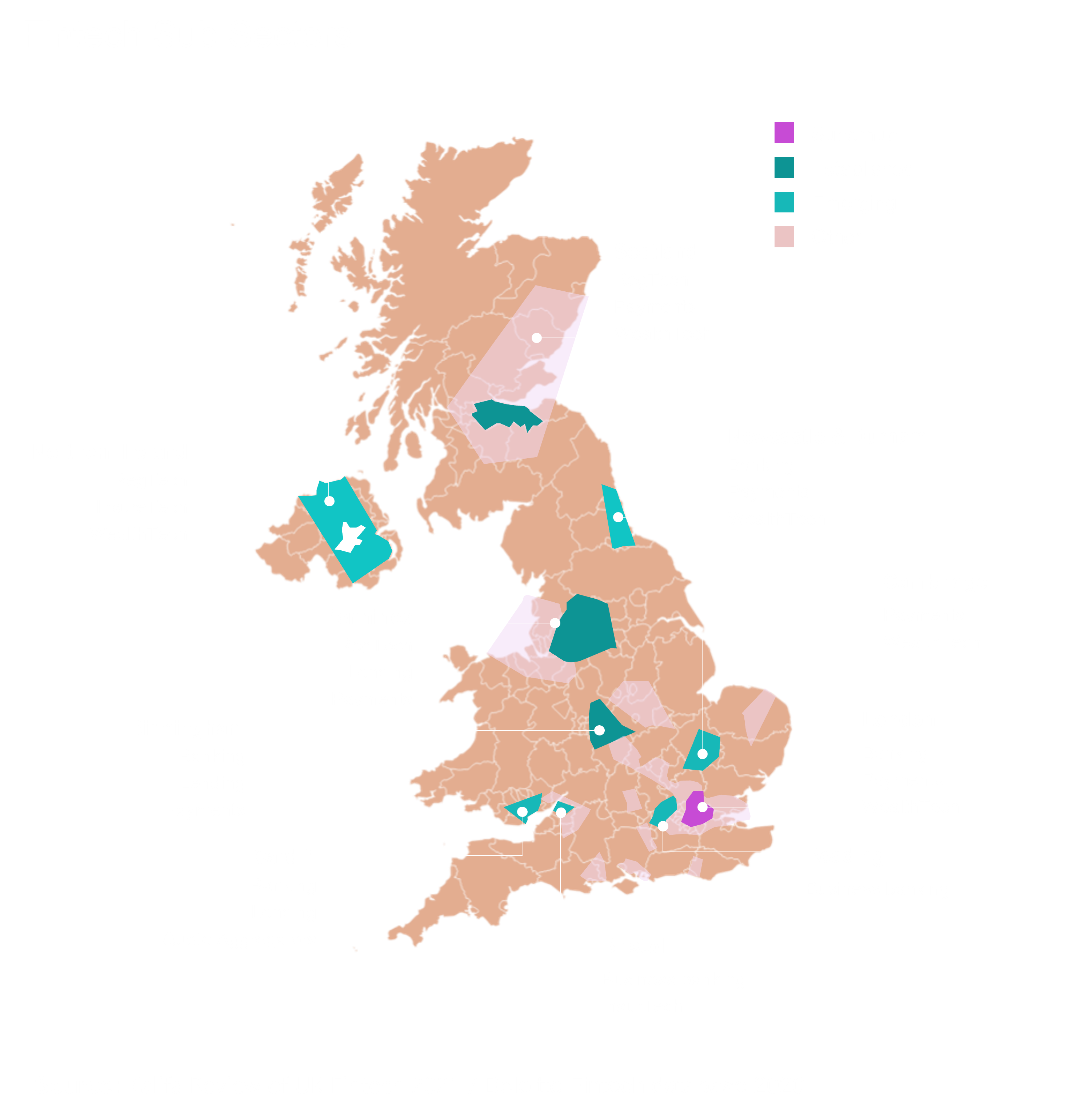

In regions across the UK, fintech is building momentum; Welsh investment jumped from £13 million to £70 million and clusters are thriving in Manchester, Leeds and Birmingham. Even Dorset saw a 32% increase in fintech firms between 2023 and 2024.

These emerging hubs (big and small) matter. They bring fresh talent, lower costs and build resilience into the ecosystem. But they still face structural disadvantages, especially around access to capital.

In 2023 London captured 46% of fintech deals and 58% of total investment, and London’s VC and PE markets remain substantially deeper than areas outside of the capital.

To build a truly national fintech economy, we need to get capital flowing beyond the M25. That means more funds with regional mandates, more partnerships with local universities and accelerators, and more visibility for founders outside the traditional London networks.

Part of building a thriving future of fintech in the UK is building one that isn’t reliant on a handful of postcodes. Talent and ambition is everywhere.

To conclude…

This isn’t the part where I say we’ve got it all figured out. Capital markets are tighter, hiring remains choppy, and regulation, while promising, needs follow-through.

But the fundamentals are strong. The UK has deep talent pools, a highly respected regulatory system, and globally significant firms choosing to build here.

This is not the time for complacency, but it is not the time for pessimism either. If government, industry, and investors pull in the same direction, there is a clear path forward.

At Fidelity International Strategic Ventures, we are proud to be backing the next wave of fintech innovators, here in the UK and beyond.

If you’re building something ambitious, we’d love to hear from you.