The Future of Finance is Fractional

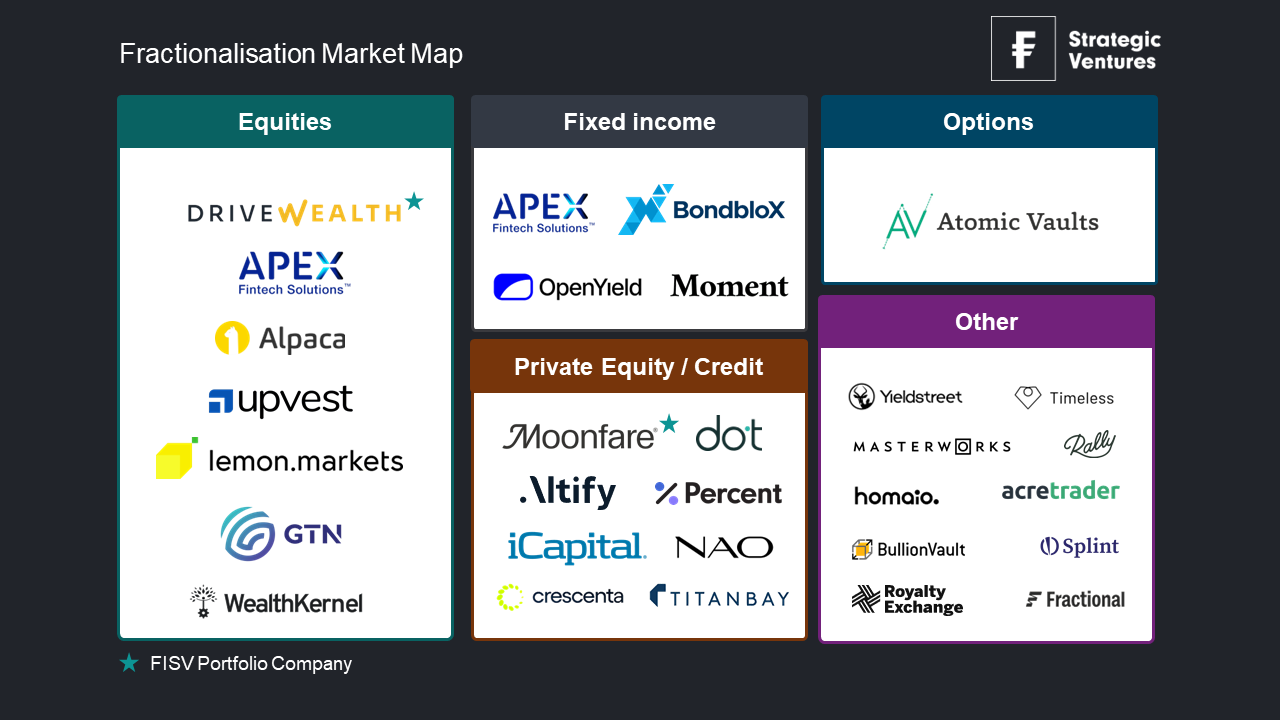

In finance, fractionalisation is not a novel concept - a stock, after all, is just a fraction of a company. “Fintech Fractionalisation” is the ability to divide any asset into smaller, more accessible parts, offering many benefits to the overall market: increased liquidity in previously illiquid or high-priced assets, democratisation of investing by allowing broader participation across asset classes, and the emergence of new financial products and services built on top of fractionalised assets.

Fractionalisation has already transformed equity investing, democratising access and breaking down barriers for millions of investors.

We’re now seeing a new wave of excitement form as this trend expands into fixed income, options markets, and other asset classes. It promises to unlock a new wave of opportunities for investors.

A Brief History of Fractionalisation in the Equity Markets

Imagine it’s November 2019. You’ve just received your salary and decided to invest $300 in the stock market. After analysing potential opportunities, you want to invest in Amazon, Google, and Microsoft, dividing your $300 equally across the three. You open your brokerage app only to realise Amazon stock is priced at $90, Google at $65, and Microsoft at $150. How do you split your investment? You realise you cannot buy all three stocks, so you end up purchasing one share each of Microsoft (MSFT) and Amazon (AMZN). This simple portfolio you have just created is not what you intended; it is riskier due to its concentration and is unintentionally weighted towards Microsoft.

If you try to replicate this experiment today, you can easily create your desired portfolio, investing $100 per stock. Nominal-based investing—where investors buy assets based on a dollar amount rather than whole shares—is a result of fractionalisation, and it only became mainstream in 2019. Fidelity, Interactive Brokers, and Robinhood were among the first to launch this in the U.S. market.

Today, people think in terms of $/€/£ amounts rather than number of shares; this is especially true with the younger generation and with the advent of crypto investing, where the concept of owning 0.0000x of a bitcoin is considered the norm.

Our portfolio company, DriveWealth, pioneered the API-driven infrastructure that enables brokers to offer fractional shares, paving the way for the democratisation of stock markets. DriveWealth is one of the leaders in the space, and their technology allows investors worldwide to own a piece of the stock market, something that was not possible before, especially in emerging markets like Africa, Latam, and SEA.

Fractionalisation isn’t just about the front-end experience. This process introduces significant technological complexity, requiring advanced systems to aggregate fractional trades, manage corporate actions like dividends and stock splits, and ensure seamless settlement across platforms. The scalability of infrastructure plays a huge role in the long-term viability of this trend, and fractionalisation is now expanding in other asset classes.

Fixed Income

The fixed income market is a vast and complex ecosystem, with roughly $140 trillion in securities globally, compared to $115 trillion in equities (2023 data). Despite its size, only 5% of U.S. household investable assets are held in direct fixed income investments (vs. c. 28% in directly held equities). Why? A key barrier is the high minimum investment thresholds, with U.S. corporate bonds often issued in $1,000 or $5,000 denominations and municipal bonds starting at $5,000.

We believe that to truly democratise the asset class, fractionalisation must be addressed first. However, fixed income introduces challenges: allocation of principal risk, complexities in corporate actions, and bonds being called early. Unlike equities, there’s no centralised “tape” for bonds, adding to the complexity.

We are seeing early progress, with some startups already tackling these challenges. However, there is still a long way to go.

Options

During the pandemic, U.S. retail participation in the options market surged, and today, around 45% of all equity options trades are made by retail investors, with a significant portion of this activity focused on smaller, one-lot transactions (source).

While minimum thresholds aren’t as prohibitive as in fixed income, fractionalising options could increase both trading volume and strategy flexibility. For example, fractional options could allow retail investors to execute more advanced strategies like covered calls on a directly indexed S&P 500, which might not be feasible with full contracts.

However, like fixed income, fractionalisation in options is complex, with options exercise, assignment, and the requirement to “print” on the exchange, among other challenges. The options market holds vast potential for fractionalisation, and those who solve it will gain first-mover advantages in this fast-growing space.

Other Asset Classes

Fractionalisation is making waves in a variety of other asset classes. One of our investments is Moonfare, which enables direct access to top-tier private equity funds. One of the first players that opened up the PE/VC fund investments to retail, lowering the minimum tickets to €10k.

Other asset classes increasingly accessible through fractionalised ownership include real estate, startups, music royalties, and physical assets like art, wine, farmland, and cars. It is important to note that fractionalisation is not always the panacea to liquidity; for inherently illiquid assets, it can sometimes create dependence on obscure secondary markets that lack transparency and fairness.

The rise of blockchain, and specifically tokenisation, could be pivotal for fractionalization. Tokenisation allows assets to be split into smaller parts, represented as tokens on a blockchain, which can then be traded with smart contracts automating functions such as dividend payment and compliance checks. This has the potential to revolutionise how we think about ownership and liquidity for assets (my colleague Jingwei recently published an insightful piece on tokenisation here).

At FISV, we believe fractionalisation will be key to increasing retail participation across multiple asset classes. We’re actively seeking forward-thinking founders innovating in this space, and we’d love to hear from you.

Reach out at Marcello.Melandri@fisv.com to connect!