Themes, factors, and unidentified risks: Our investment in Theia Insights

Today, the FISV team is excited to announce our investment in Theia Insights, a Cambridge (UK) based deep tech start-up that offers foundational artificial intelligence (AI) for the global investment industry. Working in partnership with some of the key players in the financial services space, Theia is developing three core technologies: dynamic industry classification, thematic risk modelling, and portfolio analysis.

The $6.5 million seed round, alongside Unusual Ventures and Clocktower Ventures, will enhance Theia's ability to scale and fulfil the high demand for their product across the financial services industry.

Outdated industry classifications?

Stretch your mind back to the (not so recent) 1990s and take a moment to consider some of the household names we know all too well today. Apple was a manufacturer of PCs; Amazon was a newly formed e-commerce platform; and Alphabet was a search engine in its infancy. Each of these companies served a niche and, as such, could be neatly allocated a sector and industry on a one-to-one basis.

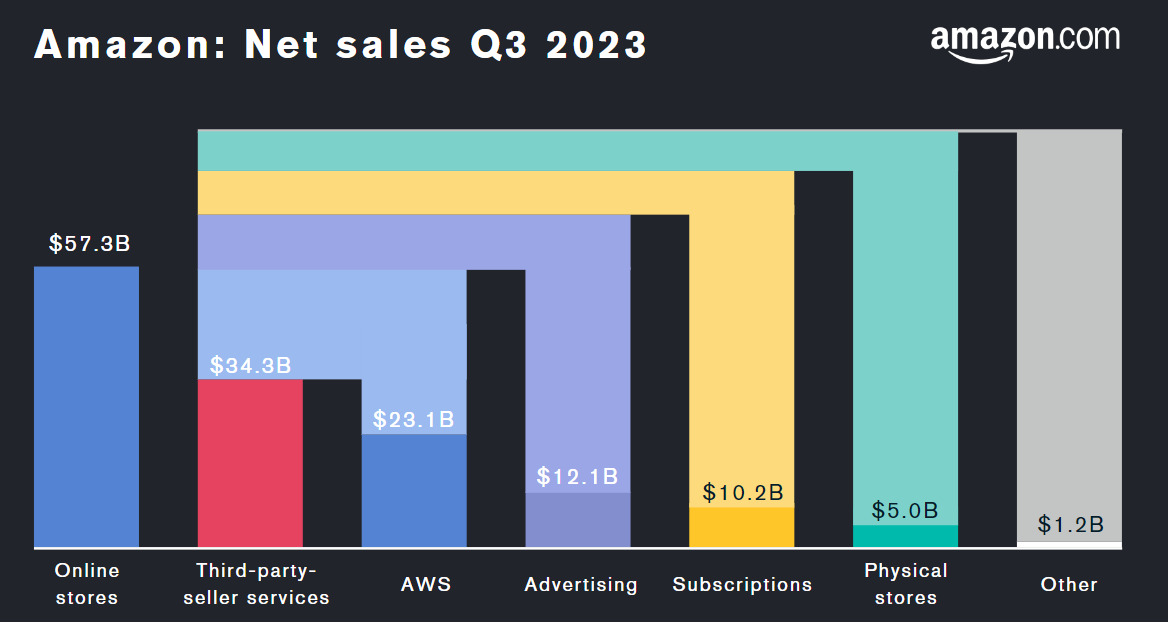

Fast forward to today, and the landscape before us is very different. A boom of digital offerings and technological advancements has allowed companies to transcend multiple industries. Apple has made forays into payments and banking; the majority of Alphabet's revenues are now derived from advertising; and Amazon generates as much from cloud computing as it does e-commerce, not to mention streaming, ad sales, or groceries. The one-trick ponies of yesteryear have evolved into the multi-faceted unicorns we see today.

While companies have evolved significantly, the categorisation frameworks that group them into sectors and industries have remained stagnant, still reliant on a one-to-one categorisation process across a number of defined tiers. While traditional frameworks served us well in the past, the dynamic landscape of today's market, characterised by companies operating across multiple sectors, calls for a more sophisticated approach. Theia Insight’s self learning dynamic knowledge graph captures the diverse activities of companies and can automatically assign multiple thematic and industry factors, providing a nuanced understanding of their risk and return profiles.

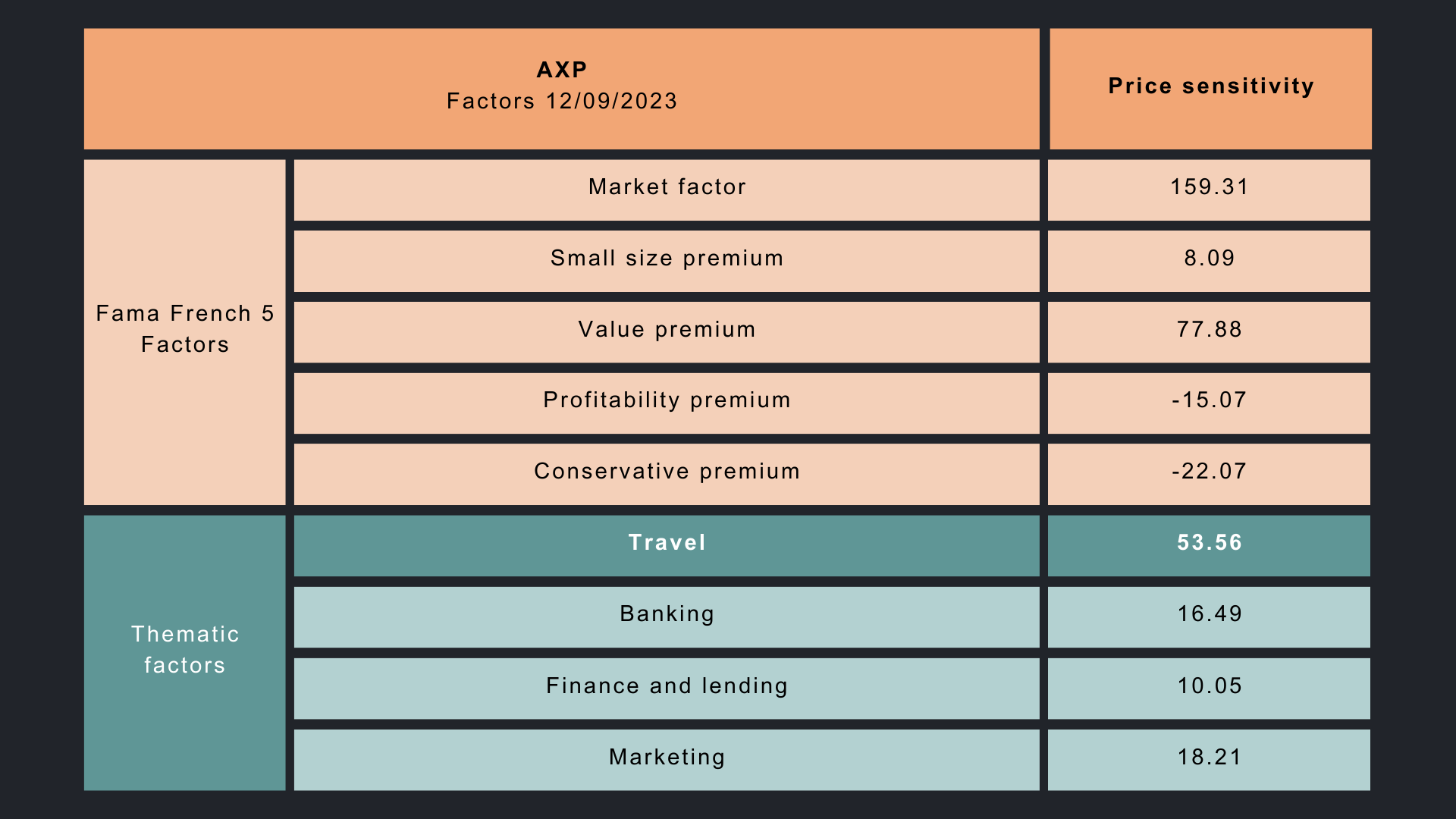

Take, for example, the case of American Express. While traditional classification systems pigeonhole it into single categories, Theia's approach recognises the diverse facets of its business, from financial services to travel and entertainment. By incorporating multiple weighted sectors and major thematic drivers, Theia's classification system offers a more accurate representation of a company's industry exposure, leading to better-informed investment decisions.

In addition to this, interest in thematic investing (a future-focused investment approach that focuses on trends that are expected to evolve over time) has risen considerably in recent years. Financial institutions are increasingly exploring and enhancing their offerings within this space in an effort to provide more personalised and interesting products to their clients. That said, current thematic strategies often lack depth, informational rigour and automation, making them slow to launch and expensive to maintain. Thematic products have come under scrutiny given portfolio construction that does not accurately track nor reflect the desired underlying theme.

Solving the problem

Akin to its namesake, Theia, the Greek goddess of sight and vision, with unrivalled accuracy and speed, Theia’s models provide distilled insights into the true exposures of companies to thousands of themes, factors, and until now, unidentified risks. Theia's technology represents a paradigm shift in portfolio analysis, enabling industry participants to construct portfolios that align more closely with their clients' investment objectives and thematic preferences, as well as better understanding risk and performance. What’s more, with its proprietary models, Theia is also able to deliver automatic fund attribution reports powered by state-of-the art factual Al capabilities and provide unparalleled clarity and insight into portfolio risk and performance drivers.

Returning to the example of AMEX, rather than using a singular category-based approach, Theia's classification uses multiple weighted sectors (Banking and Payment, Business Support Services, Investment, Tourism & Recreation, Retail), as well as major themes driving the stock (Travel, Banking, Finance & Lending, Marketing). Taking these factors into account and applying Theia's thematic factor risk model, we see that American Express’ stock is more sensitive to the travel industry than banking. This approach has a significant impact on the risk allocation of portfolios, and we believe it will be a crucial building block for the asset management industry.

The Theia team

We're particularly excited to invest in and work alongside the team behind Theia Insights. Theia's CEO Dr.Ye Tian is an energetic founder with a strong academic background in natural language processing (NLP) and computational linguistics. In addition to her experience with Amazon Alexa, she brings a diverse set of skills and business acumen to Theia. Ye realised the gap in the market for a product offering this tailored industry classification. Accompanied by Dr. James Thorne (CTO), Dr. Lemin Wu (Chief Economist) and Garrett Conway (CPO), Ye has formed a team with impressive scientific credentials and commercial expertise.

Theia has already gained notable traction and support from some of the industry’s leading names, striking up an early channel partnership with Nasdaq. Use cases for Theia’s products and solutions span traditional asset and wealth management, financial technology companies, ETF issuers, index providers and private equity firms, among others. We are excited to be a partner of Theia and are looking forward to joining them on their mission to revolutionise the industry

Interested in Theia Insights and how their solutions reflect portfolio return attributions? Read more here.

🚀 If you are a founder in the fintech industry, please reach out to a member of our team.

📩 Interested in hearing regular updates from the FISV team and portfolio? Subscribe to our newsletter here