From Abacuses to AI: the Digitisation of Alternative Assets

Alternative Assets AUM has grown rapidly…

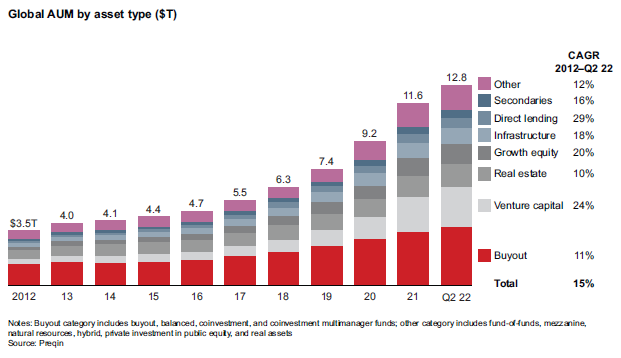

Private assets have exploded over the last decade. The AUM invested in alternative assets was $3.5 trillion in 2012, grew to $9 trillion in 2020, and is expected to reach $14 trillion by 2023.

This growth has been fuelled by a flurry of institutional investors, high net worth individuals, and family offices yearning for higher returns and diversification in a low-interest-rate environment. Investment managers - suffering from fee compression across traditional product lines - have moved to sate this demand with ranges of alternative funds spanning diverse strategies from private equity to infrastructure. Alternatives have gone from loitering around the periphery of the industry to a mainstay of modern investment management.

In spite of rising interest rates, companies are continuing to stay private for longer as public capital markets are perceived by some as primarily an opportunity for liquidity, rather than a cheaper source of capital. Despite a challenging alternatives fundraising environment, the maturity and capital availability of the private markets is sufficient to support this trend going forwards, with $1.96 trillion of dry powder ready to be deployed (as of December 2022, Preqin).

…but efficiency & access hasn’t followed.

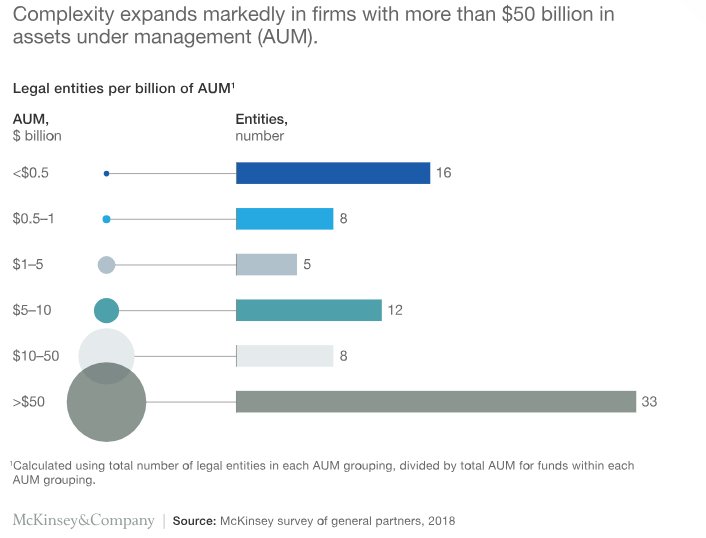

However, this rapid growth has brought significant complexity and operational overheads. There has been a vast increase in the number of LP allocations, fee agreements/side letters, and structural complexity of funds themselves (funds investing in directs & other funds, layers of SPVs, etc).

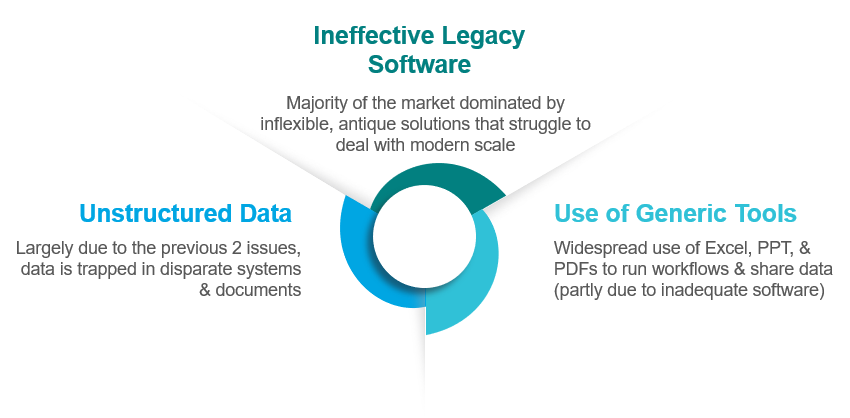

Byzantine operational and technological processes haven't changed significantly over the last ten years and are still driven by manual workflows. Due in no small part to the limitations of existing software solutions, GPs & their service providers manage a lot of core operations from valuations to reporting in spreadsheets. Reporting to counterparties is often provided in the form of PDFs, which can't be readily queried or referenced, except through manual review.

Consequently, costs are soaring, and even highly sophisticated Tier 1 GPs are seeing diseconomies of scale as their systems are stretched to breaking point. According to study by McKinsey, fund operations and finance particularly struggle to scale efficiently: managers <$15bn of AUM have ~5% of their headcount in operations and 9% in finance, while managers with >$15bn require ~7% of their headcount in operations and ~18% in finance. This relationship between scale and the complexity that drives operational challenges is clearly illustrated in the chart below:

With alternatives AUM anticipated to grow at a CAGR of 11.7% in the years to come and increasing opportunities to democratise access to a broader universe of investors (such as with ELTIFs & LTAFs - designed to help channel retail capital into alternative fund managers and with the ‘ELTIF 2.0’ framework coming into effect in Jan 2024) - the operational challenge for GPs will continue to compound.

The digitisation of private assets is beginning…

To tackle these challenges, there must be broad based digitisation of operations across GPs, LPs, & service providers, underpinned by modern software.

For these efforts to be successful, there is a pressing need to first solve the issues of unstructured data. Data that is stuck in a wild abyss of unstructured and semi-structured formats requires frequent manual interventions and reconciliations and prevents straight through processing using digital workflows. If this mission-critical data remains trapped in excel, PDFs, or other data siloes, automation and workflow digitisation will be impossible.

For example, a fund accountant can’t perform an automated waterfall calculation for a private equity fund without having a digital record of the fund ownership and any specific fee arrangement articulated in subscription documents and side letters.

In this vein, Michael Sidgmore at Broadhaven Capital Partners recently wrote a an excellent newsletter unpacking the role of data in the evolution of private markets infrastructure - in the context of the recent >$1bn acquisition of Burgiss by MSCI - contending that the "standardization of data and performance in private markets will make it easier for investors to evaluate, allocate, and monitor alternative investments".

…with startups at the forefront of innovation.

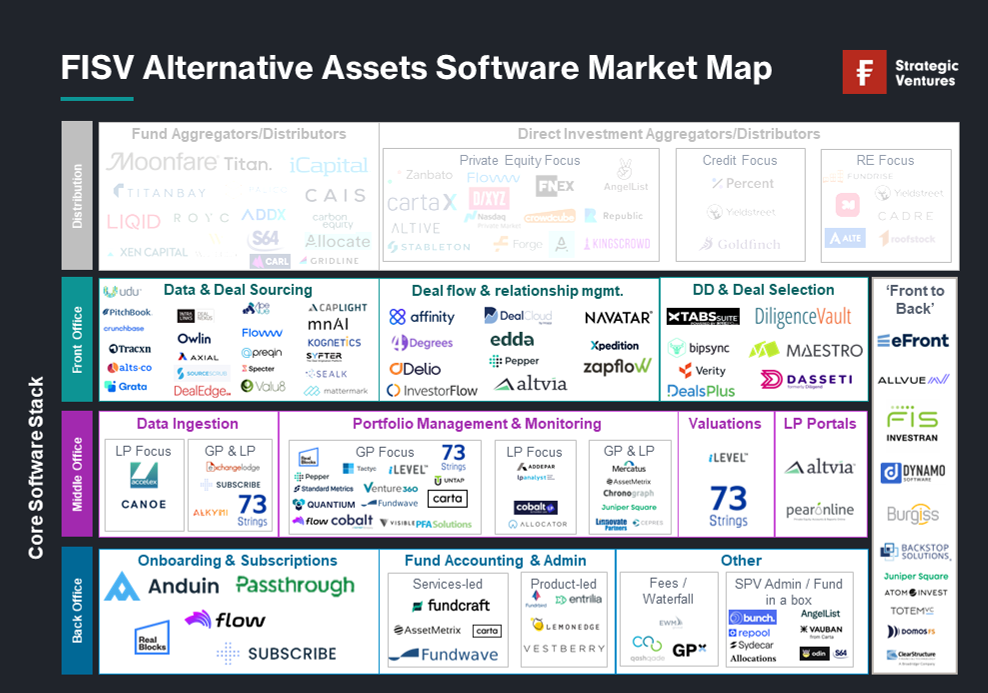

To deal with the challenges of legacy software, generic tools, and unstructured data mentioned previously, a new generation of startups has emerged, specifically focused on addressing the unique challenges associated with private assets.

(This market map is not exhaustive. I’ve excluded asset and fund tokenisation players & those who primarily serve anyone other than GPs & LPs. Who have we missed?)

Some of the most interesting areas of the stack, where we are spending our time are:

-

Valuations

This is the ongoing process of periodically valuing a funds investments. Firms perform this function by collecting information from portfolio companies (generally in the form of PDFs and spreadsheets), collating the information into a form they can analyse, and then performing valuations (typically quarterly) in Excel. They often collaborate with valuation consultants and auditors throughout this process.

A leading company in this space is 73 Strings: a platform that automates valuations and portfolio monitoring - using machine learning to ingest regular reporting data from portfolio companies and providing a software platform to support streamlined valuations & LP reporting.The company is consolidating the fragmented tooling across the middle office to provide a seamless end-to-end solution. 73 Strings differentiates on radically better parsing (~99% accuracy on tables) for data ingestion and is the only firm to offer modern, flexible valuation software.

The company has contracts with some of the largest Tier 1 GPs in the US, Canada, Europe, & the Middle east: helping to inform their allocation decisions & to provide LPs with the timely, granular, and auditable information they increasingly require. (Disclaimer: Fidelity International Strategic Ventures recently co-led 73 Strings Series A, alongside Stevi Petrelli and her team at Blackstone)

-

Fund Accounting & Administration:

This refers to the tracking and administration of the financial inflows and outflows of a fund, which is underpinned by a general ledger. Due to the structural complexities and intricacies of alternative investment firms (partnership structures, managing capital allocation, distribution waterfalls, taxation, etc) this is an extremely challenging function to manage. Legacy firms such as eFront & FIS Investran are incapable of managing the modern scale of the asset class.

Firms such as LemonEdge, fundcraft, & ENTRILIA are all innovating in this space - leveraging software to tame the structural complexity inherent to partnership accounting and automating manual processes.

Digitisation could unlock an evolution in market structure

Fidelity International Strategic Ventures believes that the market will consolidate over time, with value accruing to applications that serve as digital systems of record. By centralising and standardising data, these platforms can automate processes and facilitate effective collaboration & data sharing between different stakeholders (portfolio companies, LPs, GPs, & service providers). Solutions that capture these control points will be very sticky and are best positioned to expand their offerings to capture more of the value chain.

We are specifically interested in areas such as front office deal management systems that integrate into portfolio management infrastructure, valuations & portfolio data in the middle office, and fund accounting and administration in the back office, as centres of gravity around which parts of the stack could consolidate.

Once operations are streamlined & digitised - the way is opened for innovations such as unprecedented retail access, product innovation, and enhanced liquidity. Arbitrarily low minimums, multi-asset funds containing both public and private assets, and even more efficient secondary market liquidity (through tokenisation and the capacity for superior price discovery) all become easier to deliver, accelerating a market structure evolution that is bringing private assets ever closer to the dynamics of public markets.

If you know a startup that's not in our market map or if you’re a founder building in the private asset space, we would love to hear from you!