From Start-Up to Unicorn: A Guide to Consciously Iterate Your Team

This article was originally published at:

http://medium.com/@laura.atterwill-95718/from-start-up-to-unicorn-a-guide-to-consciously-iterate-your-team-c8233d9be6d4

Following almost a decade in executive search and having worked with dozens of companies during the scale up phase as a Talent Partner to Eight Roads and FISV, I am acutely aware of the emotional tightrope that CEOs tread as they work to curate an effective organisational culture.

Various models for organisational design exist with different trade-offs, but one thing I have observed is that whether you opt for hierarchy, matrix or a fully decentralised structure, being deliberate and prepared for the implications of your structure on cost, culture and control is essential. That said, an org chart alone cannot guarantee success. Having a roadmap is helpful but more important is to figure out what you are trying to accomplish and optimise the organisation around those goals.

In this article I aim to share some insights that may help Founders, CEOs, HR and Leadership Capital Partners to more consciously iterate their organisational structures and prepare for the next phase of growth.

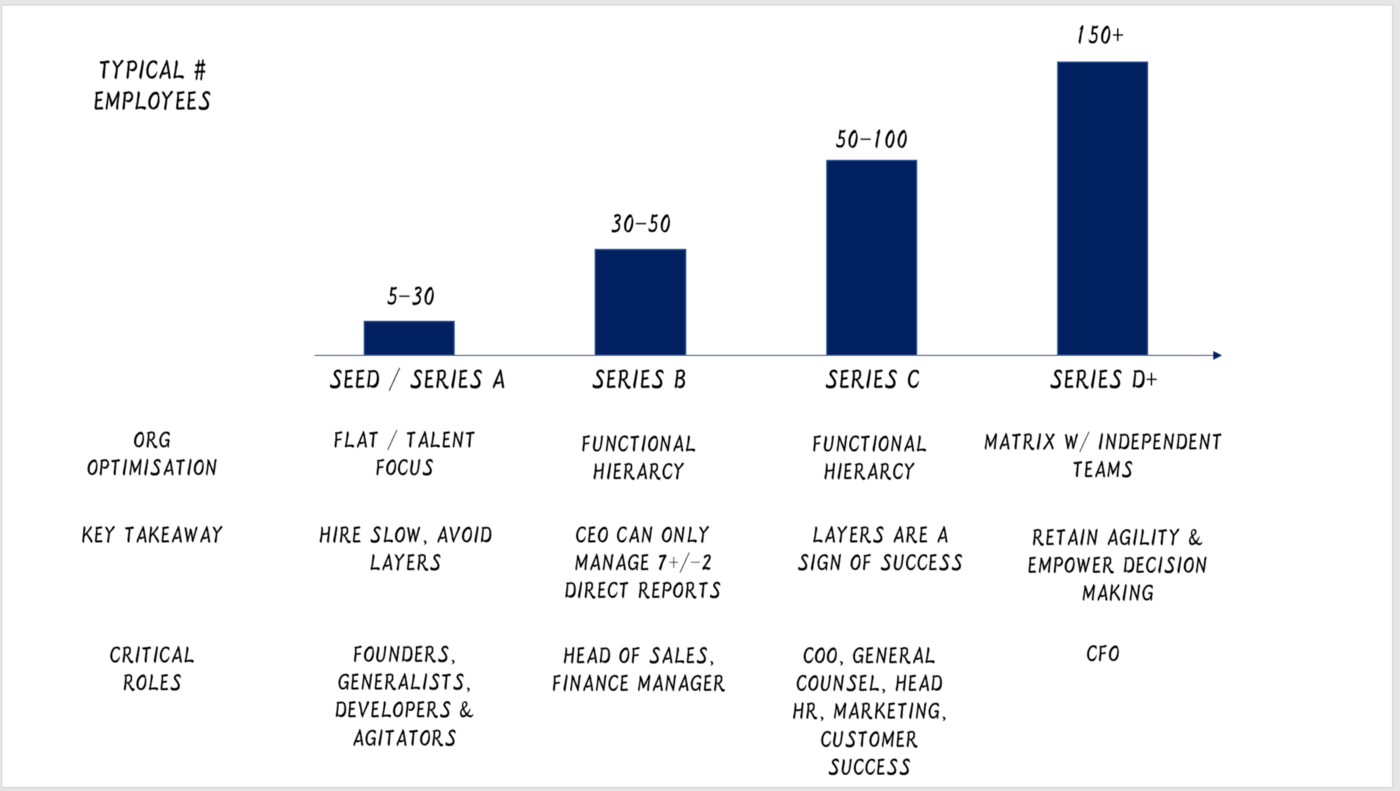

Seed / Series A (~5–30 FTE)

In the early stages of building a team, Founders realistically need to optimise for the talent at their disposal. A Founder is typically involved in every hiring decision and can maintain a relatively flat structure without falling victim to a command and control culture. Lessons from AirBnB, DropBox and Stripe all suggest that before product market fit is established, it’s ok to take a really long time to hire great people. While a clear hierarchy can reassure Founders that important decisions will be escalated, the reality is that an org chart is largely irrelevant if your product doesn’t address the needs of your target customers.

At the early stage of a company’s evolution its org structure needs to be fairly flat and flexible in order to support extremely rapid iteration. Even if the team came together as generalists, it is important to attribute responsibilities early to empower people to test and learn and make decisions quickly. In fact, pre-Series A, the presence of generic “management” functions is often a red flag signalling unresolved founder dynamics and the potential for inflated costs and cap table challenges down the line.

Series B (~30–50 FTE)

With a healthy capital injection comes the ability to expand the team and create new positions. However, beyond 30 employees, CEOs must recognise that there is an optimal span of control; Miller’s law tells us that beyond 7±2 direct reports, you may not be getting the best out of those superstar functional experts you were so thrilled to have onboarded [2].

Since most of the great Founders we back at FISV have skills we want to see deployed to tackle business or product development, at around Series B stage this is also the time we observe the need for functional support. This may lead to the creation of a COO role to manage those functions that are slower to scale (people, finance, facilities, customer service) or the recruitment of managers to standardise processes and identify opportunities for efficiency e.g. implementing a CRM tool. This is almost certainly the tipping point for hiring a Finance Manager with experience of managing internal budgets and accounts as well as forecasting.

In many of the fintech businesses I work with, this is also the stage that we see many companies move from an early sales model, most likely founder-led, to a more structured sales process and hiring that first Head of Sales can be critical to the success or failure of the go-to-market strategy.

Series C (~50–100 FTE)

This is perhaps the trickiest stage for Founders to manage since many loyal, early employees with great generalist skills required at start-up phase are found to lack the specialist knowledge to take a business to the next stage of growth. It takes a great deal of humility, self-awareness and strength in leadership to continually ask the question: do we have the right people to achieve our goals? Harvard Business School has found that leadership has a 10 to 15% impact on financial performance and a 25 to 30% impact on market valuation [3] — getting the right people on board in the right roles should not be an afterthought.

Retention also becomes more important, particularly as Founders seek to codify and protect their culture. That said, for some, the transition from functional operator to manager is uncomfortable: A COO may find they are no longer sufficiently trained (or motivated) to manage talent development, recruitment and onboarding alongside the plethora of other operational responsibilities in their job description.

Alongside HR, other roles typically appointed (or upgraded) at this stage include General Counsel (particularly crucial for data driven, high IP and regulated businesses), Heads of Marketing and Customer Success (to really dig into the customer journey and pave the way to tackling a new cohort).

This may be the first time a Founder has invested in creating new functions that fall outside of product or sales. These roles tend to take time to craft given the need for incremental skills and complementary personalities. It may also be the first time a Founder has ceded to the need to hire an executive at a higher salary point than themselves; a fact which is totally normal given Founders should be incentivised by their shareholdings and not their cash compensation…

Appointing functional leads may also result in changes to reporting lines for those that have been accustomed to having ready access to the CEO. It is vital to plan communications, be transparent and consistent with information, anticipate sensitivities and take time to explain the rationale in person.

Adding new layers to an organisation is a sign of success. Of growth and the need to professionalise. Having a manager that understands your contribution and can commit the necessary time to mentor and get the most out of your function is also an investment in your development.

Series D and Beyond (~150+ FTE)

At the 150 employee mark, there is often a sharp increase in costs due to the need to increase overheads, occasionally before long sales cycles have borne fruit or proper performance management has been implemented to eek out inefficiencies.

Assuming revenues, growth and margins are heading in the right direction, this may be the stage to start planning for a sizeable financing round or even exit process? While demonstrating product prowess and great customer satisfaction will be key to achieving that next milestone, equally important will be having a CFO on-board who can manage or deliver that goal and build a function that is obsessed with capital efficiency and delivering against KPIs.

Until this point, in most cases a hierarchy-based organisation seems to work well but how do you maintain an agile, innovative culture at scale if information and decisions are centralised? Intel CEO and management guru Andy Grove has said that every organisation of a certain scale inevitably adopts a matrix to enhance collaboration and allow for flexible resourcing. However, without designated decision makers, the danger is you inadvertently create a consensus driven culture that stifles innovation and suppresses autonomy.

This is where agile teams come into play. These are small, multi-disciplinary teams that break complex problems into bitesize projects or challenges and develop solutions to each through rapid prototyping and tight feedback loops. Eric Schmidt has often been quoted on the ability of small teams to change the world:

"Every successful project I have worked on within Google over the past 40 years has started off with 1–2 people working on an idea together" [4]

Eric Schmidt, former CEO & Chairman, Google

In order to succeed, agile teams need to be self-governing and close to the customer (internal or external), unencumbered by layers of control and approval and perfectly positioned to test and learn.

Maturing companies will often go through significant organisational transformations since they

"…require financial discipline that is not an event, but a pattern; strategic clarity that is not a direction, but a commitment; operational excellence that is not a tool, but a mindset." [5]

New investors often force self-reflection and as organisational goals shift, so too will the talent required to deliver against them.

Making organisational changes is complex and getting to the right operating model requires thoughtful planning and communication as well as the support of investors, management team and employees.

These decisions carry emotional weight and have far reaching implications; being disciplined about having the right people in the right roles at the right stage of a company’s journey is key to maintaining a healthy culture, tight handle on costs and the appropriate controls to go all the way.

Disclaimer: opinions are my own and do not necessarily reflect those of Fidelity International Strategic Ventures, Fidelity International, Eight Roads or any affiliated parties.

[1] https://blog.samaltman.com/

[2]https://en.wikipedia.org/wiki/The_Magical_Number_Seven,_Plus_or_Minus_Two

[3] https://hbr.org/2017/08/pe-firms-are-creating-a-new-role-leadership-capital-partner

[4] https://www.forbes.com/global/2005/1114/054A.html#452f8d92530b

[5] https://hbr.org/2017/08/pe-firms-are-creating-a-new-role-leadership-capital-partner