Since 1975, Fidelity has been a provider of retirement solutions. Now a market leader in the pensions and workplace services space, Fidelity supports millions of employees globally across retirement, benefits, share plans, investments and advice.

At Fidelity International Strategic Ventures, workplace is an area we are actively exploring, investing and forging partnerships between our portfolio companies and Fidelity. If you are a start-up operating in this space, please reach out; we’d love to hear from you!

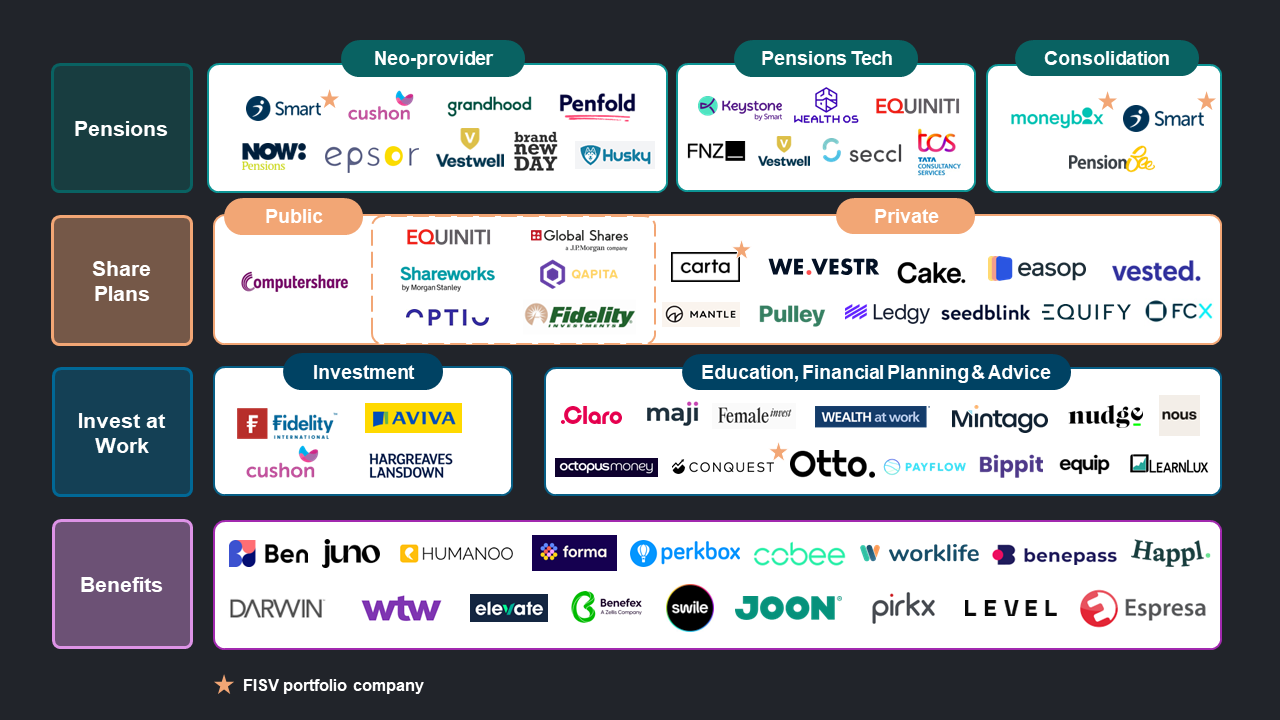

Our workplace map explores the businesses that make up this space, highlighting those innovating and propelling the wider industry forward. If you think we’ve missed a player, let us know!

What challenges lie ahead?

Providing pension customers value for money while being a profitable provider

The global shift from defined benefit (DB) to defined contribution (DC) continues at pace. In the UK, DC assets have been growing at 11% CAGR since 2017, supported by auto-enrolment legislation, market movement and contributions. However, while this megatrend is in full force, there are few pension businesses that can operate both profitably and provide clients with value for money. With fit-for-purpose modern technology and operations, this is possible, and we are beginning to see traction and desirable unit economics from a handful of players. Legacy providers stuck on platforms that were not purpose built for DC will struggle unless they move and rethink their operating model.

Delivering tangible value from private share plans

Companies are staying private for longer. The median age of companies going to IPO in 1999 was 4 years; by 2018, it was roughly 13 years. Given the IPO drought we are seeing now, these timeframes only look set to extend. This trend creates several challenges for companies trying to manage their stakeholders and incentivise employees. There has been significant growth in the number of firms administering private share plans. However, we are also seeing the need for employees to have liquidity windows and secondary opportunities ahead of an exit, along with more effective education and communication around the value of their plan. Finally, when businesses transition from private to public, there are few firms that make this process an easy transition for stakeholder and employee share plan management via a truly integrated approach that works for staff globally.

Actionable financial planning

Financial concerns often top the list of reasons why employees are stressed, as managing retirement, debt and wider financial life can be challenging. Increasingly, businesses are offering support to employees to guide them through important life stages and optimise their outcomes. These initial interactions are funded as a benefit, either directly through the corporate or through their retirement provider, and can include advice, guidance, tools, education and direct payment at source. While conceptually, this is not new, we are seeing several innovative approaches that resonate with employees.

Providing benefits that matter

Large companies typically use brokers to access a range of employee benefits. Firms are expecting brokers to provide global perspectives while also retaining tailor-made solutions at the local level. However, this comes at a significant cost, with execution often missing the mark. For companies with 10,000 -100,000 employees, the commission on broker-intermediated benefits can range from $500,000 to $15 million and is increasing at 8% per annum.

Small businesses face challenges too. They must find competitively priced benefits that employees value, without contracting with too many providers. Platforms are developing their services, offering locally tailored and meaningful benefits, that employees can select for themselves. The heavy lifting is handled by the provider rather than the employer, and all at a more competitive price point than large-scale brokers. We believe this approach, if executed correctly, can revolutionise the employee benefits market and provide better outcomes for employees.

Research from Fidelity suggests women are looking for support from their employer at key life events with themes including illness, job security, and retirement. Employers should explore providing benefits that are flexible enough to cater to these different stages.

Read more research from Fidelity around the benefits of balance here.

Our workplace investments

Master Trust provider in the UK & pensions platform technology provider, deployed to clients globally

Workplace financial planning tools

Empowering employees to have a say on the stewardship of their retirement investments

SIPP and pension consolidation provider

Cap table and employee share plan management, acquired by Carta in 2022

Brokerage-as-a-service provider powering HSA accounts