As we take stock of the fintech landscape in 2024, it's evident that the fervour of 2021's funding frenzy has waned. Buoyed by optimism and a bullish market, the post-pandemic funding heights often set companies up with a comfortable two-or three-year runway. Fast forward to today, and those funds (even if managed conservatively) are nearing exhaustion. A recent report from Morgan Stanley has underscored this reality, indicating that more than 50% of unicorns will need to seek additional capital before the year's end.

Now, with the pressure mounting to raise new capital, startups face a critical reckoning: what progress has been made since the last funding round? Has their growth rate remained steady or accelerated? Have they met or surpassed their forecasts? And perhaps most importantly, have economic headwinds elongated sales cycles for their products or services? For many, the responses to these lines of inquiry will likely be “flat, steady, not met, elongated,” not exactly the winning ‘VC Bingo’ card investors seek.

Today's funding environment marks an interesting shift for founders who, during the frenzied pace of 2021, were sought after by every VC under the sun. Now the roles have reversed: investors are increasingly seeking more for less. For startups seeking fresh capital, the road to raising will likely be far longer, tougher, and more competitive than before. As the funding ecosystem faces constraints and runways come to a halt, it is a sad inevitability that many will not raise again, often marking their end.

What may be of some comfort amid this gloom is to consider the cyclical nature of what we face today. Reflecting on the dot-com bubble and the post-covid heights of 2021, it’s hard not to draw comparisons between the two. Through-the-roof valuations, widely unprofitable business models and (often) first-time founders. While the bursting of the dot-com bubble saw the demise of many, this period too saw the emergence of industry behemoths, the likes of Amazon, eBay and Nvidia, that still exist today. Arguably, in times of hardship, only those with excellent product-market fit, a clear route to profitability and an adaptable leadership team can weather the storm. Those who do emerge will have gleaned invaluable lessons, setting them up for enduring success.

The bursting of a bubble, too, can mark a turning point for the funding ecosystem. With VCs and investors coming away with a heightened sense of prudence, they begin to embrace a more cautious and discerning approach to investment, implementing thorough due diligence processes and a more diversified portfolio. A decline in “VC tourism” leaves founders better placed to work with investors whose expertise and resources can provide meaningful support and strategic guidance beyond an initial funding injection.

Growth investors are now laser-focused on discerning a glimmer of hope amid the tunnel of cash burn. With increased scrutiny, founders need to be ready to demonstrate what they have achieved and provide proof and metrics as to how they have reached their inflection point. So, what’s the road ahead for start-up founders and management teams? Here’s my advice.

Focus on the Fundamentals:

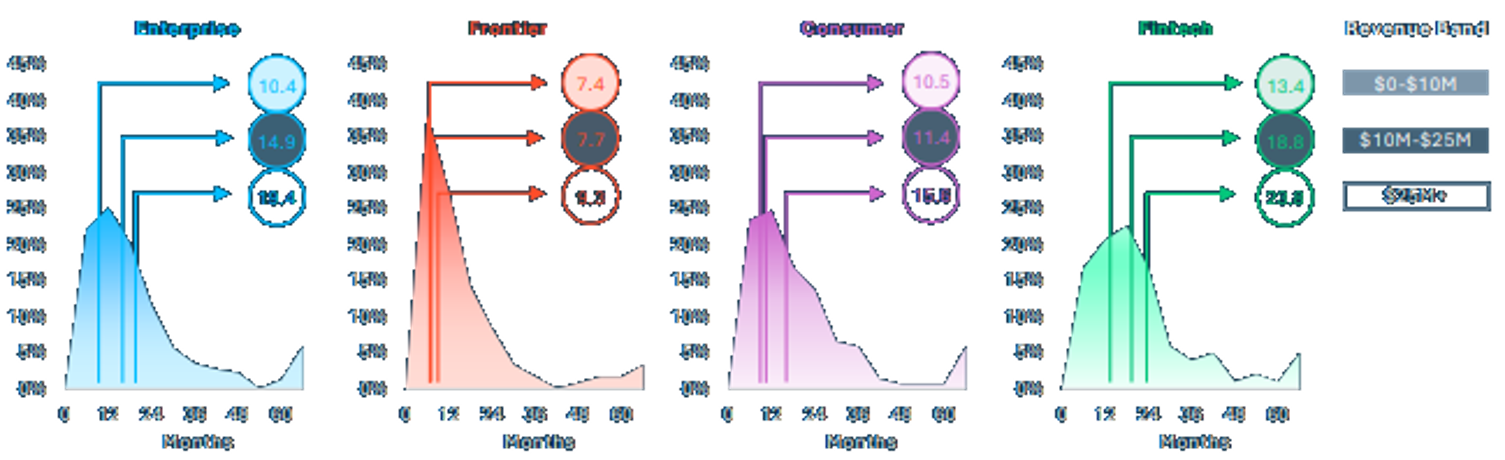

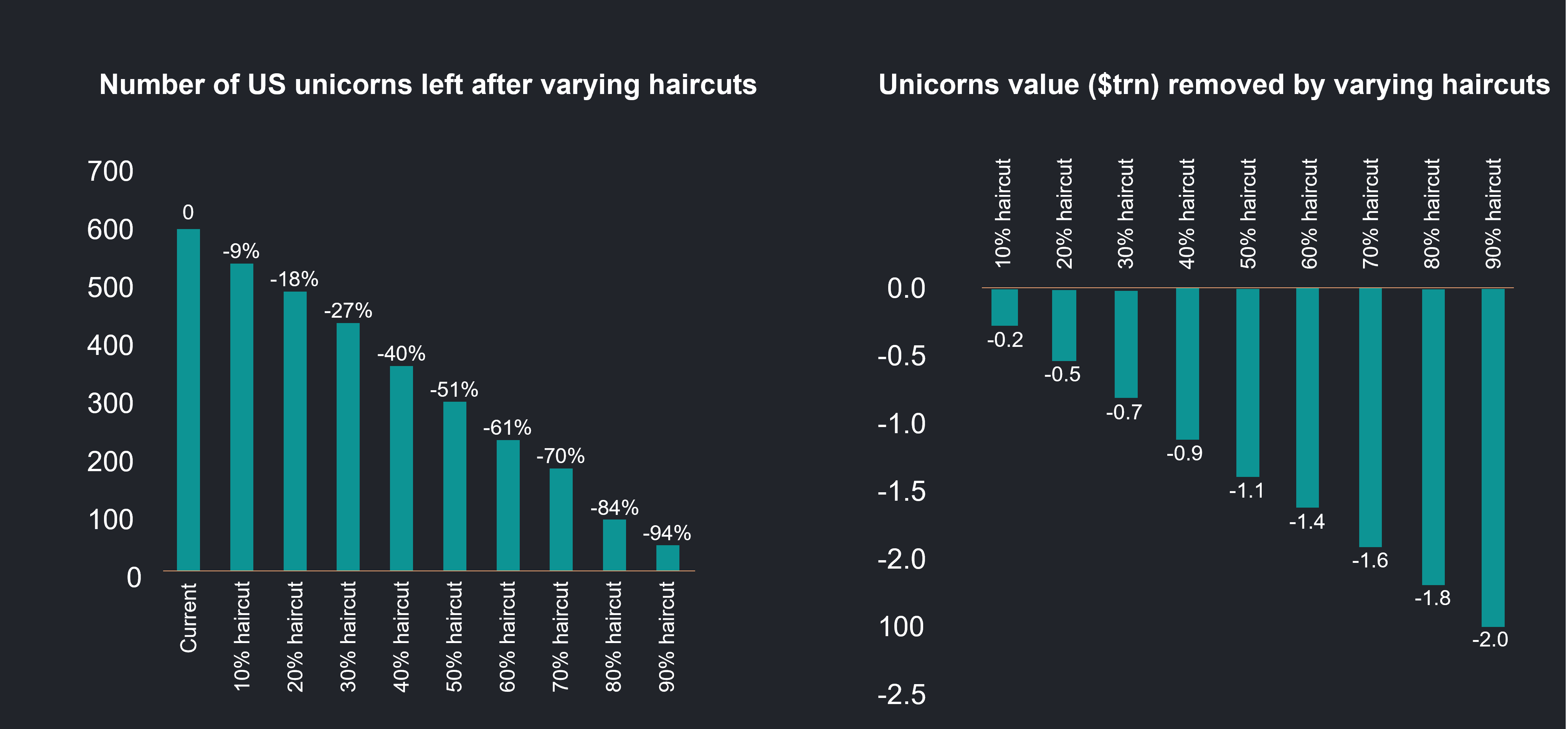

Investors have and will shift their focus from speculative hype to fundamentals. We will see increased emphasis on profitability, sustainable growth, and viable business models rather than solely relying on user acquisition and market share. The coveted unicorn status, once a metric that demarcated companies destined for longevity and success, has lost its glitz. Once rare, unicorns are now commonplace, and the susceptibility to being crowned or de-crowned at the whim of investors has seen many argue for other more robust metrics to be used as proxies for success. As one article highlights, founders need to ditch their unicorn dreams and instead focus on centaur status, “reaching the $100 million ARR threshold that connotes having the product, go-to-market and operational competencies to endure.”

Know your product (and your market):

Obvious but paramount. For founders raising in the current climate, knowing your customers and how your product meets and solves their needs is key. With shifting consumer behaviour and evolving market dynamics, anecdotes and superstitions are not enough; founders need clear, actionable data to serve as the foundation of roadmaps and explanations as to what and where funds deployed will be spent. A strong grasp of product-market fit informs resource allocation, prioritisation, and iteration decisions, optimising offerings and driving sustainable growth. In essence, founders equipped with this insight not only weather storms but are equally poised and confident to capitalise on emerging opportunities.

Don’t dread the down round:

The bursting of the bubble led to a much-needed correction in the market. It brought valuations back to more realistic levels, separating sustainable business models from speculative ventures. This rationalisation laid the foundation for more stable growth in the tech industry. While, with the exception of AI, the ecosystem appears divided into haves and have-nots, the optimal strategy for founders is simple: raise a pragmatic amount of capital that can sustain the business until it achieves cash flow breakeven and beyond. All sounds easy enough until you factor valuations into the equation. Straddling the line between art and science and predicated on growth trajectories and profit margins, pricing is a challenging task for investors and founders alike. However, ensuring each round is priced correctly is a crucial part of the funding cycle.

Part of this process, is understanding when and why to take a down round. Increasingly, I am seeing puzzling scenarios where founders are pushing to draw a line in the sand from the high watermarks of 2021 and entertain the notion of a down round. Their existing investors, however, staunchly resist, fearing the repercussions on their own performance metrics and subsequent fund raises.

So why consider taking a cut to a valuation? If priced fairly, a down round offers a silver lining. It not only allows new investors to enter at sensible valuations but also (and arguably more importantly) resets the Employee Stock Ownership Plan (ESOP), ensuring that employees' options aren't rendered worthless, keeping their skin in the game with future wealth incentivization. Instead, the prevailing trend sees companies clinging to lofty valuations, opting instead to take on complex structures like liquidation preferences and minimum return thresholds. This proverbial kicking the can-down-the-road approach is shortsighted and merely postpones the inevitable, delaying the much-needed reset that could propel the company forward.

This isn’t to say we should encourage markdowns at any cost, and ultimately, any savvy founder wants to keep their investors happy. Flexibility, when occurring on both sides of the table, can foster a more harmonious and ultimately more profitable ecosystem for everyone. As long-term, patient investors, we advocate for a path characterised by clean terms, minimal structure, and transparent, sensibly priced rounds. Such an approach fosters alignment across management teams and investors, paving the way for sustainable growth and meaningful exits.

Hero image generated via Canva AI