Unbundling the Asset Management Stack

This article was originally published at:

https://medium.com/@josh_65046/unbundling-the-asset-management-stack-c4a2cfee0057?sk=68662742ebfb9dc2bc96769d00722d8a

The Asset Management software stack is on the verge of seismic change. Asset Managers are seeing costs explode, fees in freefall, and customers are becoming frustratingly (but understandably) demanding. Fettered by legacy system architectures — many firms are severely limited in how they can respond. However, a new emerging stack of unbundled solutions coupled with a data-centric approach could provide absolution from the sins of the past, while positioning managers to adapt to the needs of the future.

Today, 60% of firms have a siloed architecture — with an application specific approach to data — and only 4% have implemented a truly data-centric architecture.

Consequently, while 89% of asset managers view data as a strategic asset that gives them a tangible competitive advantage, only 39% of firms consistently have access to the high quality data they require. [1]

The asset management software landscape is dominated by a small number of large incumbent firms, most of whom have existed for decades, hampered by technical debt and overly broad product lines. What started as a desire to act as a ‘one-stop-shop’ for asset managers software needs has — fed by prolific acquisitions — culminated in extremely broad front-to-back solutions that are too often a ‘jack of all trades, but master of none’.

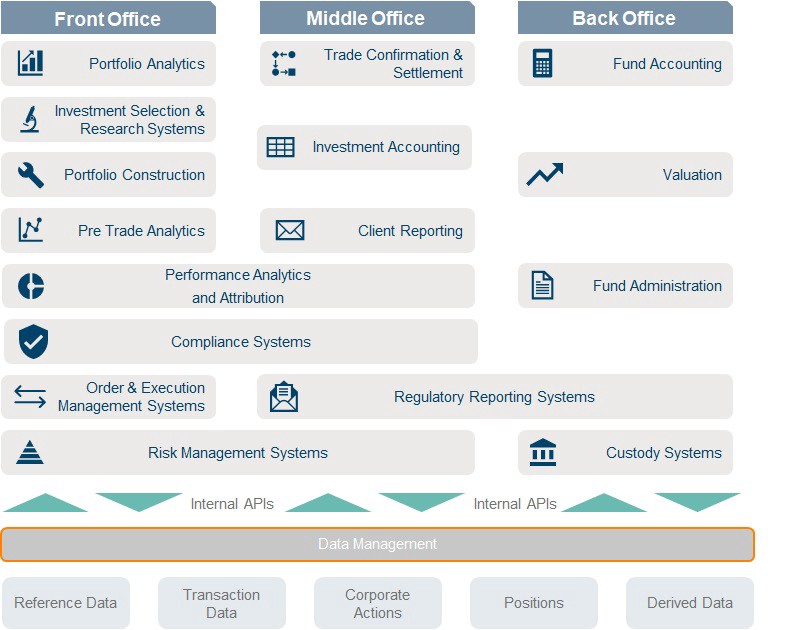

The Asset Management Tech Stack

This viewpoint is far from exhaustive and will vary from firm to firm. Delineations between front, middle, and back office are also sometimes slightly nebulous. Front to back solutions aim to provide much (but not all) of the functionality above with a unifying data model, some going as far as to provide data management technologies.

In reality, large legacy solutions have specific areas of relative strength. Aladdin is considered industry leading in risk analytics, while SimCorp has relatively superior data management capabilities.

Consequently, most asset managers have been compelled to bolt together a variety of tech platforms in order to gain sufficient capabilities (a 2018 survey showed that only 6% of managers opt for a single front-to-back solution). Many managers have a variety of different technological subsystems — demarcated by asset class — leading to a highly complex (and fragile) system-of-systems. The manifold integrations between these systems involve difficult trade offs — as firms seek to balance capabilities at the fund level with analytical insight at the firm level. Managers who seek the simplicity and reduced reconciliations of a front to back system must inevitably suffer inferior functionality and despotic vendor lock in.

What a tangled web we weave

These sprawling networks of integrations have developed over time into expensive, inflexible, and brittle constructs — hampered by poor quality data and manual reconciliations across systems. This structural problem has lead to:

Difficulties meeting new regulatory requirements

Challenges adding new asset classes and products

Poor quality data and consequently flawed analytics and reporting

Barriers to the adoption of new technologies

This has resulted in spiraling costs of operations and technology for asset managers — growing at an 8% CAGR from 2007 to 2017 [2].

One of the roots causes of these integration issues in the underlying architecture of these front-to-back vendors: they have exceptionally closed architectures and most have shown a profound reticence to develop flexible, well documented, open APIs. In many cases, these aging legacy stacks are monolithic and require significant and radical re-architecting to embrace a more modular approach that puts integration at the fore.

From the perspective of the software vendor, this might superficially make sense: closed architectures create greater vendor lock-in and can create opportunities for cross-selling.

From the perspective of the customer — the experience is akin to bottomless perdition: implementation and decommissioning periods that can stretch as long as 4 years, a costly labyrinthine web of integrations built to remediate the inadequacy of the underlying platforms, and minimum system lives of 10 to 15 years resulting from the expense and disruption of migration.

Unbundling the asset management stack

The solution is simple and is rapidly building momentum: the industry needs an unbundling of these incumbent platforms and a move towards open architecture software.

By embracing a developer-friendly approach to integrations, product modularity, and consistent interface standards — asset managers would be able to choose best-in-class solutions for each functional area. This would decrease the total cost of ownership, create flexible platforms that allow for technological and product innovation, and enable the automation of manual analytical and reporting workloads.

This unbundling dynamic is far from unprecedented in the Fintech vertical, where the unbundling of retail and corporate banking has been a dominant trend for the past decade.

Unbundling of a Bank

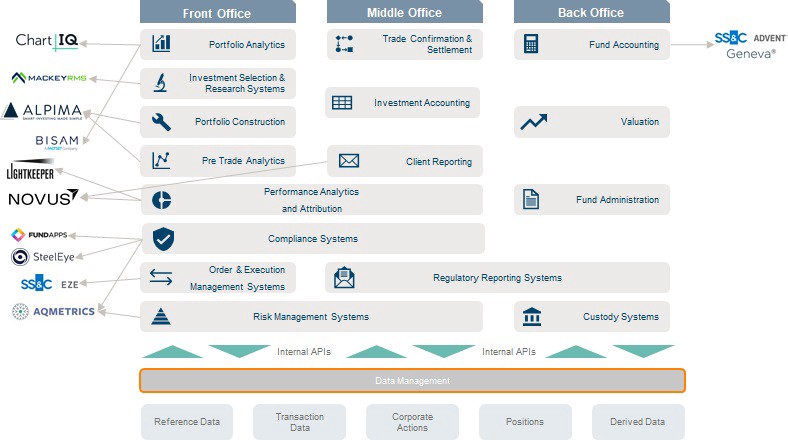

We are starting to see the beginnings of this same trend manifest within asset management software — as talented founders centre all of their attention and resources on mastering specific functional areas, rather than diluting their focus.

The unbundling of asset management software?

The market for these solutions is vast: the top 500 asset managers have an estimated operations and technology spend of $155.6 billion [3] and — once on-boarded — customers tend to be sticky.

Why now?

Several market drivers make this transition not only possible, but eminently necessary. With the industry-wide shift from active to passive investing — asset managers are seeing significant fee compression (global active & passive fees fell by 14.3% between 2012 and 2017 [4]) which is forcing them to tackle their technical debt in order to realise much needed operational cost savings.

As the recently completed acquisition of Legg Mason by Franklin Templeton demonstrates, this same trend is leading to consolidation within the industry. Large managers increasingly view the synergies that can accompany scale and diversification as a way of staying competitive (Franklin Templeton estimates $200m in annual cost savings from the integration [5]). The typical need for profound post-merger technological rearchitecting makes a change in the architectural paradigm even more necessary.

Ultimately, asset managers can no longer afford to be content with the status quo

The final piece of the jigsaw

It seems necessary that the cornerstone of any transition to an unbundled asset management stack will be a sophisticated and vertical-specific approach to data integration and data delivery. Today, 31% of managers haven’t implemented a data lake (or similar flexible data repository) and the most popular tools used for data governance and/or metadata management are Excel and Word. This simply has to change. [1]

Emerging data management technologies — such as persistent data fabrics and data virtualisation — must be coupled with deep financial services domain expertise to facilitate the creation of flexible and extensible data models that can represent a wide variety of asset classes and facilitate the rapid creation of stable integrations between different systems.

A granular, consolidated firmwide view of investment and reference data is a requirement to unlock the possibilities of the unbundled stack.

The future beckons

Furnished with unified investment data, previously impossible constructs suddenly become theoretically feasible — such as an ‘app store for asset management software’, with a catalogue of pre-built integrations, semi-standardised APIs, and comprehensive SDKs. Asset managers could leverage a single platform to purchase and access pre-configured stacks of software solutions and tech enabled services to suit their specific requirements.

While the end state of this unbundling is unclear — it is safe to assume that the consequent increased agility, efficiency, and capacity for internal innovation will lead to a profound shift in the operating model of asset managers. Unfettered from monolithic legacy systems, asset managers would be able to focus on generating superior customer outcomes — rather than expending time and resources struggling with the Gordian knot of cross systems integrations.

At Fidelity International Strategic Ventures , we are looking to invest in talented founders building unbundled software for the asset management industry. If you are such a founder — I would love to hear from you: please reach out to me on LinkedIn or Twitter.

Disclaimer: opinions are my own and do not necessarily reflect those of Fidelity International Strategic Ventures, Fidelity International, or any affiliated parties.

[1] Cutter — Various Surveys

[2] McKinsey, Achieving Digital Alpha in Asset Management, 2018

[3] Assuming a 17bps Tech & Ops Cost/AUM ratio — and taking the AUM of the top 500 managers as $91.5 trillion (Willis Towers Watson, 2019)

[4] PWC, Asset & Wealth Management Revolution, 2018

[5] Financial Times, Franklin Templeton swells assets to $1.5tn with Legg Mason Deal, Feb 2020