Why we invested in Finbourne

This article was originally published at:

https://erik-mostenicky.medium.com/why-we-invested-in-finbourne-4b32dda6e794

Our investment into Finbourne has its origin in our team’s first offsite back in 2019, on the South Bank of Thames, we were discussing how profoundly the operating model of Asset Managers is changing.

I argued (and still believe) that the future of asset management would be distributed, not centralised. The model would become service driven, rather than product driven. We could leverage Fidelity International’s deep expertise and next gen asset management software modules to offer other players in the market a game changing proposition.

Asset management trading backbones are archaic and struggle to keep up with modern technology trends dominated by APIs, interoperability, & customer-centric requirements. This is aligned to the unbundling trend that we’re seeing in Asset managers' tech stacks that Josh wrote about a few months ago. Due to unbundling, Asset Managers experience friction in onboarding vendors and service providers which has led to a number of failed integrations.

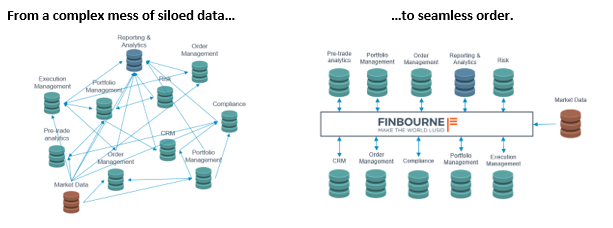

In summary, we believe there will be an influx of demand for agile technology within buy-side firms requiring integrations with existing capital markets software vendors. But — for this to be successful — firms need centralised, unified data that reduces friction and enables seamless integrations. This is where Finbourne comes in.

Finbourne is a data integration & management platform built for the needs of buy-side players that suffer from data harmonisation, integration, and management issues due to data being siloed across various legacy systems. The team at Finbourne have built an incredible product that a number of the world’s largest financial services players have already adopted.

Finbourne’s success is ultimately the product of superior technology, a stellar management team, and impeccably timed market entry into an industry on the edge of radical transformation.

🚀It starts with the market opportunity

Asset management has changed. Prices are falling. The rise of ETF’s has made many products identical. Customers expect a service tailored to their needs. Smooth digital experiences and automation of human intervention are an absolute necessity.

Asset managers need to change with the times — but are held back by significant data problems. When Goldman initiated coverage for SimCorp, they argued adoption of 3rd party software vs in-house built for buy-side increases Return on Equity from 9.7% to 11.5%. Combined with the explosion of interest in cloud-based data warehousing like Snowflake, we are confident in the double-digit growth CAGR for data management forecasted by Gartner.

When I was working on the acquisition of Sungard by FIS, everyone was struggling to get the capabilities to handle multi-asset investments — but today we see a huge demand from clients to incorporate alternative assets (real estate, VC, PE, infra) into solutions. On top of that, the world of fund structures is becoming ever more complex (from UCITS to SICAVs, RIAFs, LTAFs, LTIFs) which increases the need for a flexible data platform (like Finbourne’s).

Legacy software vendors claim to integrate illiquid assets, but given that incumbent software solutions were not designed with this in mind, adding more exotic assets is an extremely painful data challenge. Preqin & BCG forecast alternative asset AuMs to grow from $7.2trn to $12.9trn in the next 5 years, far eclipsing the growth in public equities, forcing traditional Asset Managers and their technology stacks to facilitate this growing demand.

CTO’s must resist the siren call of the status quo and demonstrate to the C suite how much revenue is being lost, as a result of poor consumer outcomes due to legacy systems. Market validation is accelerating — with recent announcements demonstrating building momentum around this trend — such as State Street’s HUB concept, BlackRock’s partnership with Snowflake or McKinsey’s analysis of the scale importance in Trading.

🤖Followed by a brilliant team able to develop a nextgen product

At FISV, we place a big importance on team and talent and we feel really fortunate to be able to partner with a team as strong as Finbourne’s. Tom, Dermot, & broader management have a level of domain expertise that deeply impressed Fidelity International.

Finbourne have created a platform that ingests all of firms accounting and investment data in one place, in a standardised form. Finbourne stores data in a way that allows for total auditability and for a user to rewind time to see what their portfolio looked like at a specific point in the past, based on information at the time. Finbourne then easily integrates with any of the firms existing platforms via common APIs: forming a unified data storage layer (creating a data-centric architecture). The governance layer then allows internal & external users to access permissioned data sets without hassle.

Anyone who wants to geek out on the (very interesting) specifics should have a look at Finbourne’s SDK’s, create a free trial account and let the magic of LUSID play its cord.

🥽Fidelity’s customer-centric model builds on top of data

Our investment into Finbourne is the first step in morphing the operating model to be client/solution focused and a break with the product driven model. By leveraging Finbourne’s intelligent book of record to drive better outcomes for institutions and ultimately individual investors.

Fidelity International’s partnership announcement is a testament to the forward-thinking leadership that has identified the value in working closely with a cutting-edge provider like Finbourne. The Technology and Investment management leadership recognise the importance of building the future of the Asset management model on managing data properly hence they will start with operational data store rationalisation, expanding the data model across strategic partners, and enabling client interaction on a safe governance layer.

Voila, Asset Management 2.0 here we come.