Why we invested in Moneybox

This article was originally published at:

https://medium.com/@michael.sim/why-we-invested-in-moneybox-b00c169c1ca0

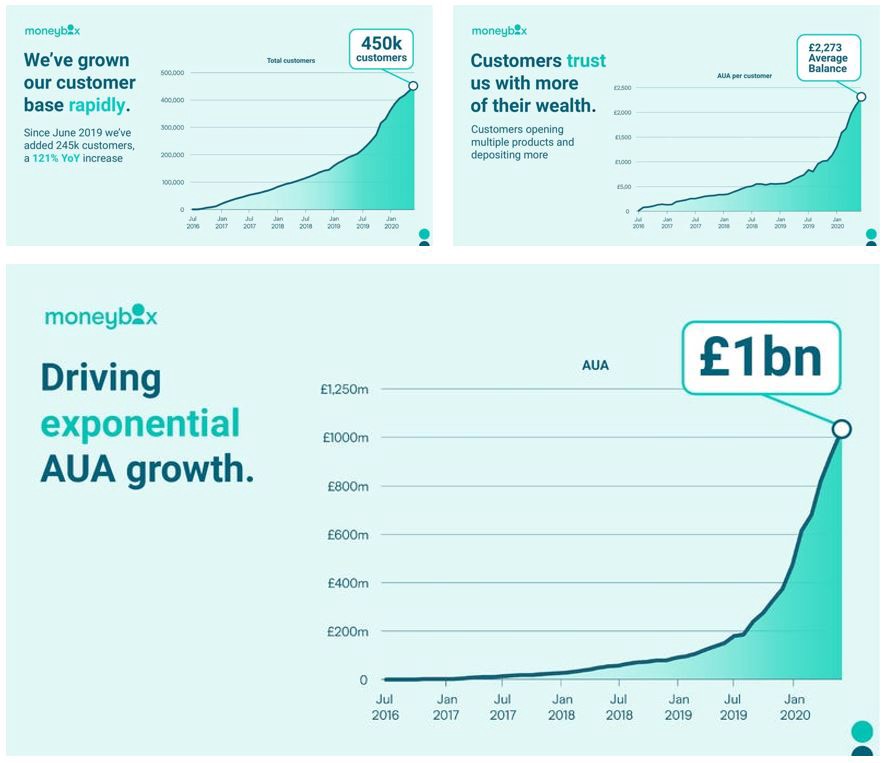

Moneybox has recently closed their Series C round of £30m and topped it up with a hugely successful £7m crowdfund. We wanted to outline why Fidelity International Strategic Ventures are so excited to continue with them on their journey. I’ve had the pleasure of working closely with the team since early 2018 when we made our initial investment and it’s inspiring to see the original thesis play-out, while creating strong foundations for further growth.

Underpinning any successful company is a strong management team. Ben Stanway and Charlie Mortimer have defined a bold vision and built a stellar team with flawless execution. They’ve also designed an organisation that has scaled effectively whilst retaining its culture, resulting in being recognised as one of the hottest UK companies to work for.

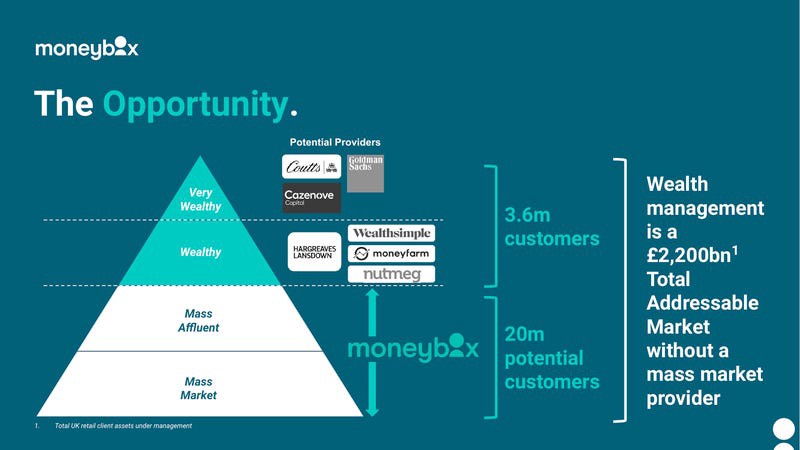

1. An overlooked market opportunity

If you’re in the top 2% of the population in terms of income or wealth, you can afford to get a lot of help with your savings, investment, and financial planning — while the remaining 98% of the population get almost no help at all.

The idea that a market as established as investing could be so exclusionary seems illogical. Surely the process of investing into funds should be straightforward, low-cost and accessible to everyone. After all, in the UK we all have access to current accounts and some form of savings accounts (however low the interest rate) — so why not investment accounts?

Incumbents prioritise profitable clients

On the face of it this makes sense, but underlying this are two other critical points:

Revenues on Assets are decreasing + Costs to serve customers are increasing.

The result is the level at which a client becomes ‘profitable’ for many incumbents has been rising causing them to focus on a narrower base of older, wealthier clients, at the expense of those trying to build from a more modest beginning.

Similarly, according to unbiased.co.uk, if you were looking for financial advice ahead of investing £10k the typical cost would be £300 — so you are 3% down before you even start.

Aside from the pricing, the asset management industry throws additional barriers in the way of a curious saver who wants to start investing. The jargon-filled advertising is designed for those that know their ISAs from their GIAs and their ETFs from their OEICs (🐷).

The result is a generation who’s working life has been shaped by the Global Financial Crisis of 2008 having to navigate their personal financial journey with limited guidance or advice. We fully subscribe to the notion that democratisation of financial markets is a good thing and there is room to build a trusted brand offering wealth management for the mass market.

2. Significant financial tailwinds for millennials

We’ve been conditioned to picture the feckless millennial, living their best life, fueled on avocado toast and overdrafts. As a generation they’re better known for student debt than forward planning and so is it any wonder millenials are ignored in wealth management? Millennials have no wealth.

First, we should acknowledge the term ‘millennial’ encompasses an age range of 23 to 39 and so represents a cohort that are largely established in their working lives and not as penniless as they once were.

Second, there are strong financial tailwinds that are allowing millennials to incrementally build substantial wealth:

The average first time home buyer in the UK saves for 8 years to amass a deposit for their home. On average this is around £20k, but is closer to four times that in London.

Pension auto-enrolment was launched in 2012 and has now ratcheted up to 8% of earnings. With studies showing that the average young worker changes job four times in the ten years after graduation, that leaves a lot of stranded pension pots. Most young people have a pension wealth saved through past-employers, but often do not know how much, who it’s managed by, what its invested in or how to access it.

Lastly, according to Forbes some lucky millennials are due to inherit their portion of $68Trn by 2030.

Moneybox is building a service that makes it easy and accessible to get started, yet engages on the key savings missions. These longer duration goals increase customer retention and grow assets in a predictable fashion.

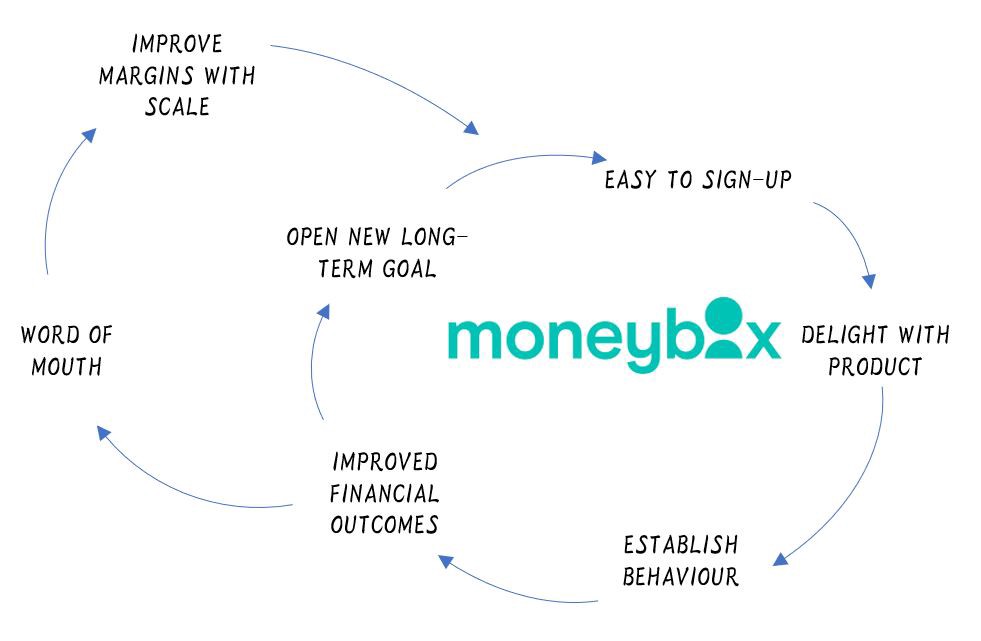

3. The flywheel effect

Getting people started and engaged is THE most important factor. Once customers are invested in a platform it opens up tremendous opportunities and creates a virtuous circle

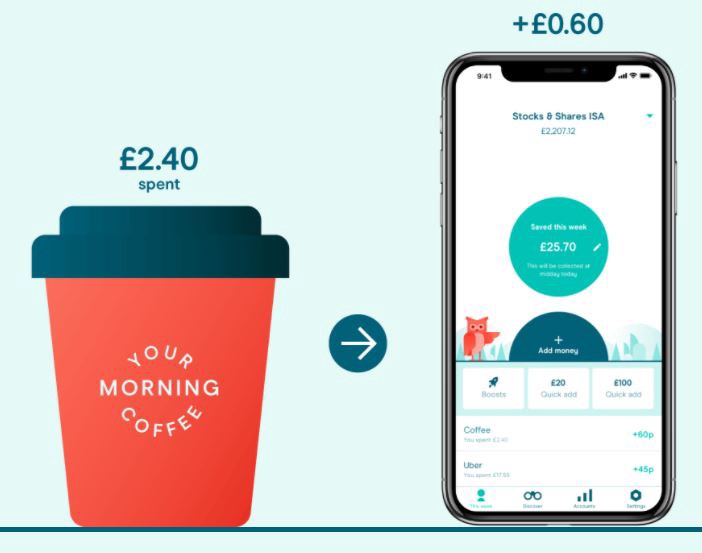

When Moneybox first came across my desk the initial impression was that it takes a lot of 60p’s to make an Asset Manager.

In a recent 11:FS podcast, host Sarah Kocianski admitted to initial scepticism that went a step further:

“If I’m rounding up my change I should not be investing it… If that’s all I’ve got, I shouldn’t be sticking it in an investment account, I should be saving it and trying to find a way to make my money work for me”

Sarah Kocianski

I outline these two points because it highlights why many people in finance - including myself initially - were dismissive of the round-up concept as a business proposition. For Moneybox the round-up is a marketing and engagement tool. It invites customers to give it a go and signals this is a financial service that fits in with your lifestyle; it is both understandable and convenient.

It is not how they make money.

Traditional VC’s have tended to shy away from asset gatherers because it’s viewed as capital intensive to acquire customers and the returns associated skew towards the latter years. Where Moneybox break this mould is in an extraordinarily low Customer Acquisition Cost, combined with a £1 per month subscription cost, enabling them to recoup the marketing spend in a short time period - even for lower balance customers.

Once customers begin saving through Moneybox they tend to engage frequently, with 62% of users checking the app monthly. This means regular interaction with customers at a time when they are thinking about savings goals - housing, retirement or other large milestones. This is the flywheel effect that Moneybox has nurtured; through ease of access and delighting the customer they establish a savings behaviour that improves a customer’s long-term finances. That in turn encourages more savings goals and drives exponential growth in Assets Under Administration (AUA).

Through building a strong proprietary tech stack Moneybox now has the foundations to enhance the product selection and experience, fundamentally changing the way a generation engages with previously intangible and unachievable long-term goals.

Moneybox’s mission is to help everyone save and invest for their future. The team has executed impeccably thus far to reach over 450k customers and £1bn of assets in a few short years. And they’re just getting started.

4. Our strategic angle

Moneybox caters to a very different audience than the typical Fidelity customer in the UK, however many of the behavioural insights and technological approaches can be translated. Part of our investment approach is to enable cross-pollination of ideas and themes between our portfolio companies and Fidelity International. To date, we’ve structured sessions between Moneybox and Fidelity on personal investing, workplace investing, marketing, fund and portfolio design and cyber security.

Moneybox’s customer centric approach can continue to provide valuable insights to a more complex entity such as Fidelity. I’m particularly excited about the opportunities in designing the ‘World’s Best Pension’ and the type of funds and personalisation that could underpin a pension that truly engages the consumer.